Class 12 TBSE Economics Suggestion 2024

Class 12 Micro Economics

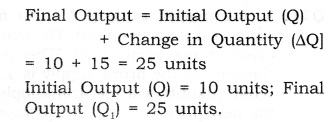

- Chapter 1 Introduction to Economics

- Chapter 2 Consumer Equilibrium

- Chapter 3 Demand

- Chapter 4 Elasticity of Demand

- Chapter 5 Production

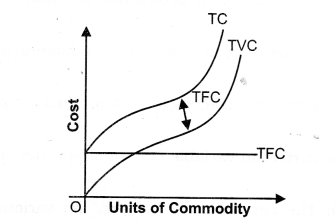

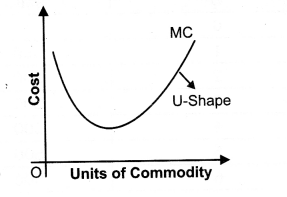

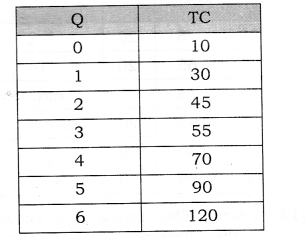

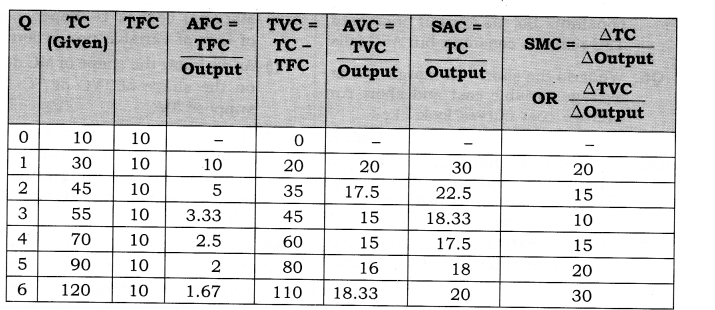

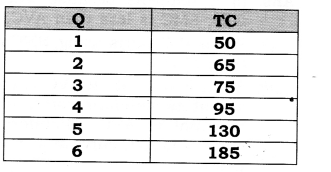

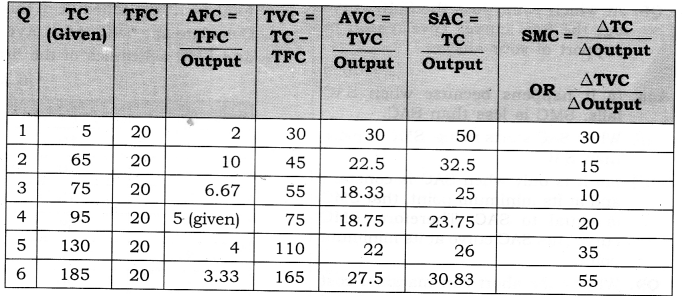

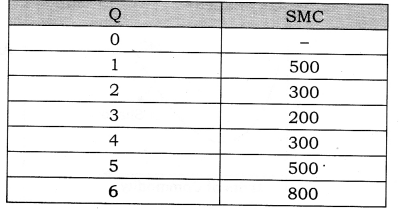

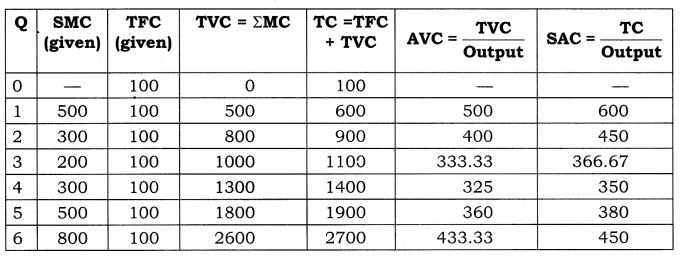

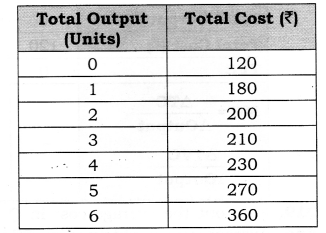

- Chapter 6 Cost

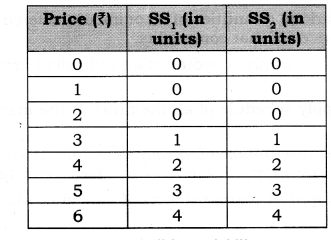

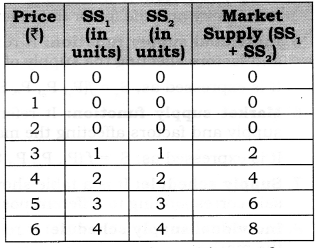

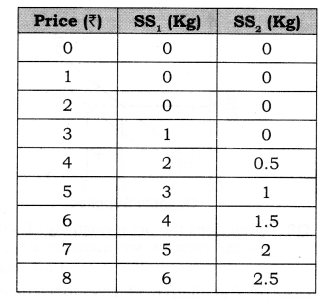

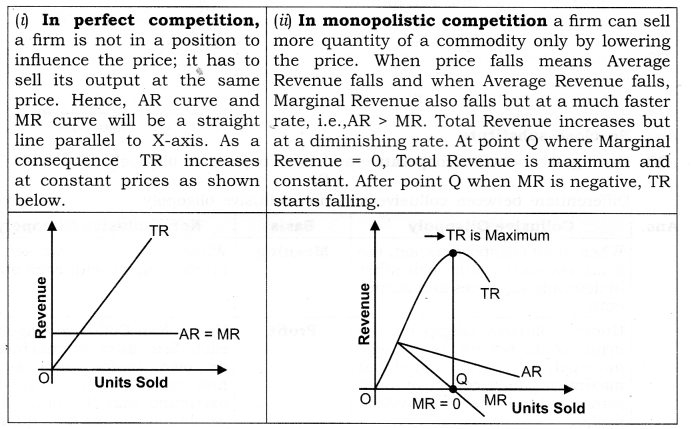

- Chapter 7 Supply

- Chapter 8 Revenue

- Chapter 9 Producer Equilibrium

- Chapter 10 Perfect Competition

- Chapter 11 Non-Competitive Market

- Chapter 12 Market Equilibrium with Simple Applications

Class 12th Board English Suggestion 2024

BEST & 1ST CUET COACHING AT AGARTALA

Class 12 Micro Economics Chapter-1 Introduction to Economics

QUESTIONS SOLVED

-

What to produce?(a) What to produce refers to a problem in which decision regarding which goods and services should be produced is to be taken.(b) Since its resources are limited, every economy has to decide what commodities are to be produced and in what quantities.(c) ‘The guiding principle for an economy here is to allocate resources in such a way that gives maximum aggregate utility to the society.

-

How to produce?(a) How to produce refers to a problem in which decision regarding which technique of production should be used is made.(b) Goods and services can be produced in two ways: by using labour intensive techniques, and by using capital-intensive techniques.(c) The guiding principle for an economy in such a case has to decide about the techniques of production on the basis of cost of production. Those techniques of production should be used which lead to the least possible cost per unit of commodity or service.

-

For whom to produce?(a) For whom to produce refers to a problem in which decision regarding which category of people are going to consume a good, i.e., economically poor or rich.(b) As we know, goods and services are produced for those who can purchase them or have the capacity to buy them.(c) Capacity to buy depends upon how income is distributed among the factors of production. The higher the income, the higher will be the capacity to buy and vice versa. So, this is a problem of distribution.(d) The guiding principle is that the economy must see here that important and urgent wants of its citizens are being satisfied for the maximum possible extent or not.

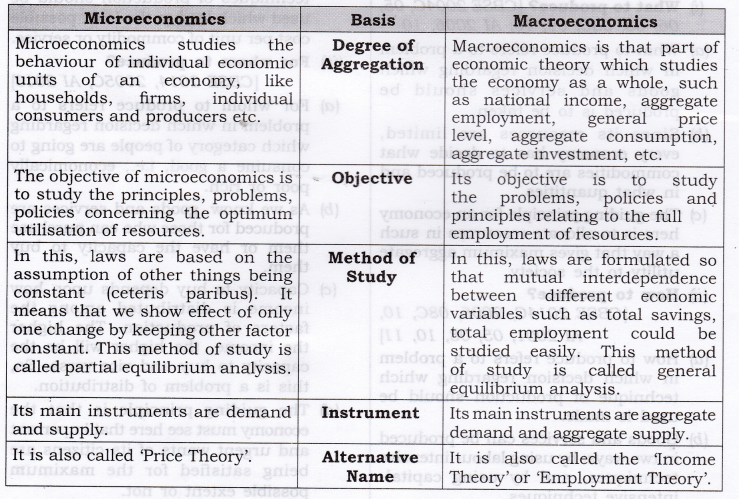

- The subject matter of economics includes microeconomics and macroeconomics.

- Microeconomics, studies the behaviour of individual economic units of an economy, like households, firms, individual consumers and producers etc. It does not study the economy as a whole.

- Macroeconomics is the part of economic theory that studies the economy as a whole, such as national income, aggregate employment, general price level, aggregate consumption, aggregate investment, etc.

MORE QUESTIONS SOLVED

- Resources are limited.

- They have alternative uses.

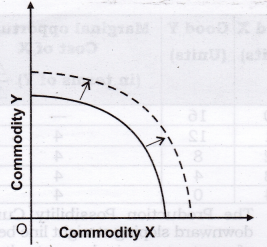

- Supply of skilled labour (like IT engineers) has increased in India causing a rightward shift in the production of IT software.

- Discovery of oil reserves in the gulf countries has caused a substantial shift to the right in the PPC of these countries.

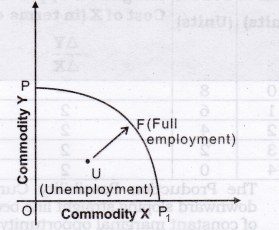

- Related to less developed countries: Labour is underutilised as indicated by mass unemployment in countries like India.

- Related to developed countries: Capital is underutilised during depression when production is decreased owing to lack of demand.

- Individual demand;

- Individual supply; and

- Individual income.

- Aggregate demand;

- Aggregate supply; and

- National income.

- What to produce and in what quantity?

- How to Produce?

-

Wants are unlimited:(a)This is a basic fact of human life. Human wants are unlimited.(b)They are not only unlimited but also grow and multiply very fast.

-

Resources are limited:(a)The resources to produce goods and services to satisfy human wants are available in limited quantities. Land, labour, capital and entrepreneurship are the basic scarce resources.(b)These resources are available in limited quantities in every economy, big or small, developed or underdeveloped, rich or poor. Some economies may have more of one or two resources but not all the resources.(c)For example, Indian economy has relatively more labour but less capital and land. The U.S. economy has relatively more land but less labour. No economy in the world is comfortable in all the resources.

-

Resources have alternative uses:(a)Generally a resource has many alternative uses.(b)A worker can be employed in a factoiy, in a school, in a government office, self employed and so on.(c) Like this, nearly all resources have alternative uses. But the problem is that which resource should be put to which use.

Question 2. Give reasons for the following statements:

- Every economy has to make the decision relating to what to produce.

- Problem of choice arises because available resources have alternative uses.

Answer:

- As, we know there is no economy in this world which possesses infinite resources to produce each and everything in infinite quantities.Therefore, if an economy decides to produce a quantity of one commodity, then they have to sacrifice the production of another commodity.

- Resources in eveiy economy are always scarce. But the available resources can be put to alternative uses. Therefore, an economy will always prefer to make use of its resources in production of those goods and services that are most required and sacrifice the production of less- required goods and services.

- What to produce and in what quantity?

- How to produce?

- For whom to produce?

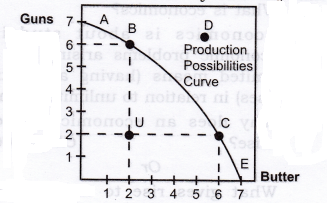

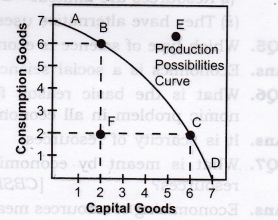

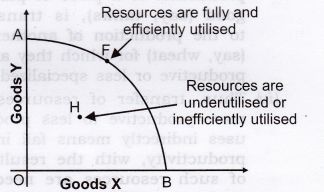

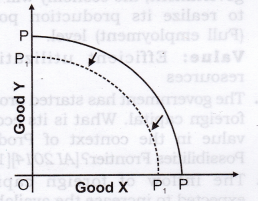

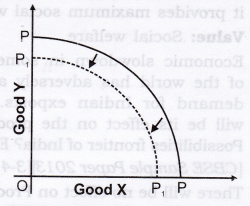

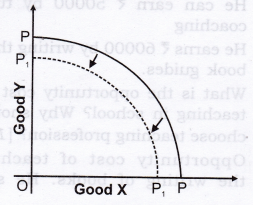

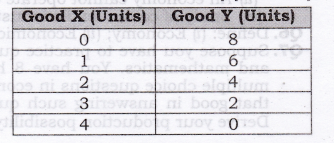

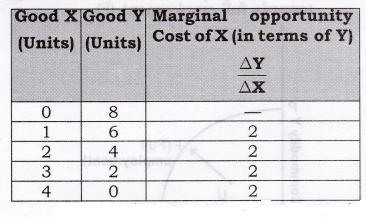

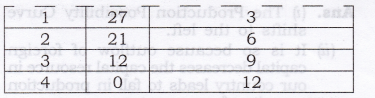

- PPC is downward sloping: The downward slope of PPC means if the country wants to produce more of one good, it has to produce less quantity of the other goods.

-

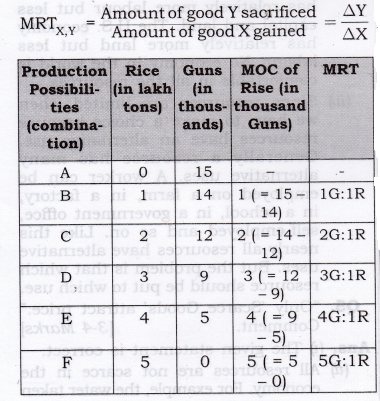

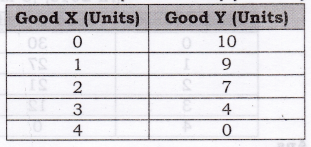

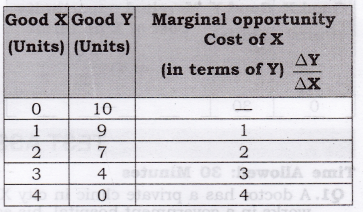

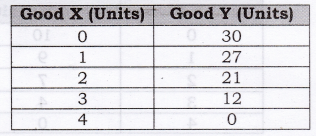

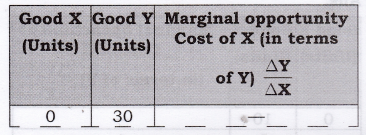

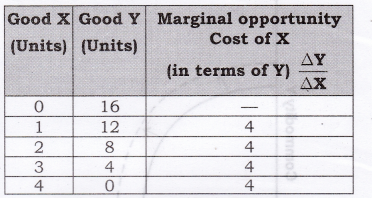

PPC is concave to the point of origin: Concave shape of PPC implies that the slope of PPC increases. Slope of PPC is defined as the quantity of goods Y given up in exchange for additional unit of goods X.[Slope of Production Possibility Curve]=ΔYΔX=

AmountofGoodYlost

AmountofGoodXgained[Slope of PPC] = MRT = [Marginal Opportunity Cost]

- First, the amount of resources in the economy is fixed.

- Second, the technology is given and unchanged.

-

Third, the resources are efficient and fully employed.Using the figure given below answer the following (Q.9 & Q.10).

- PPC is concave because of increasing marginal opportunity cost (MOC).

- This behavior of the MOC is based on the assumption that all resources are not equally efficient in production of all goods.

- Rise in opportunity cost occurs when factors (resources) which are specialized or more adopted for production of a piece of particular good (say, tanks), is transferred to the production of another good (say, wheat) for which they are less productive or less specialized.

- Thus, transfer of resources from more productive to less productive uses indirectly means fall in their productivity, with the result more of such resources are needed to produce an additional unit of the other commodity. Thus marginal opportunity cost goes on increasing making the PP curve concave in shape.

Question 10. Give reasons for the following statements:

- A Production Possibility Frontier is always a downward sloping concave curve.

-

An efficient economy would always produce a combination of goodsthat lies on the given Production Possibility Frontier.

- Growth of an economy is represented in the form of a rightward shift of a Production Possibility Frontier.

Answer:

-

A PPF slopes downward to indicate if an economy chooses to produce more of one commodity, then it would have to reduce the production of another commodity.The concave shape of PPF is due to Increase in Marginal Opportunity Cost.

-

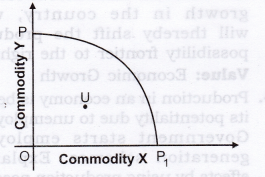

Any point on a given PPF presents a production possibility wherein all the available resources in an economy get fully utilized.Any combination located below the given PPF shows an under utilization of available resources. Likewise, any point to the right of the PPF is beyond the available resources.

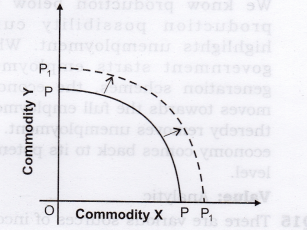

- By economic growth, we mean that an economy has developed greater capacity to produce larger quantity of goods by acquiring more resources. Graphically, this would be represented by a rightward shift of PPF.

- Marginal opportunity cost is an addition to a cost in terms of a number of units of a commodity sacrificed to produce one additional unit of another commodity.

-

Marginal opportunity cost can also be termed marginal rate of transformation, Marginal rate of transformation is the ratio of number of units of a good sacrificed to produce one additional unit of another commodity.

- We defend this statement because scarcity arises as resources are limited. The resources to produce goods and services to satisfy human wants are available in limited quantities. Land, labour, capital and entrepreneurship are the basic scarce resources.

- These resources are available in limited quantities in eveiy economy, big or small, developed or underdeveloped, rich or poor. Some economies may have more of one or two resources but not all resources.

- For example, the Indian economy has relatively more labour but less capital and land. The U.S. economy has relatively more land but less labour. No economy in the world is comfortable in all the resources.

- Since resources are limited, then we have to make a choice because resources have an alternative use. Generally a resource has many alternative uses. A worker can be employed on a farm, in a factory, in a school, in a government office, self-employed and so on. Like this nearly all resources have alternative uses. But the problem is that which resource should be put to which use.

- The given statement is correct.

-

All resources are not scarce in the economy. For example, the water takenfrom river or air we breathe is abundant in relation to wants. Such goods are available free of cost. These goods are known as Non-Economic Goods.

- On the other hand, some goods are scarce in relation to their wants. For example, diamonds, petrol, electricity, etc. are scarce in relation to wants. These goods command price and are known as Economic Goods.

- Rainwater should be conserved by rain water harvesting.

- Water wastage should be avoided i.e., economical use of water.

Value: Awareness about efficient use of water.

Question 15 There are various sources of income a teacher has; such as,

- He can earn Rs 40000 from teaching in school.

- He can earn Rs 50000 by tuition/ coaching

-

He earns Rs 60000 by writing the help book guides.What is the opportunity cost of his teaching in school? Why should he choose teaching profession? [1 Mark]

Answer: Opportunity cost of teaching is the writing of books. He should choose teaching profession because it provides maximum social welfare. Value: Social welfare

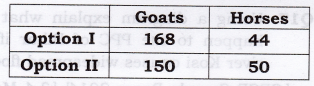

1

1

186

31

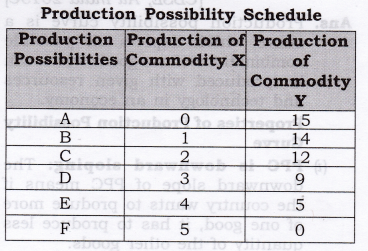

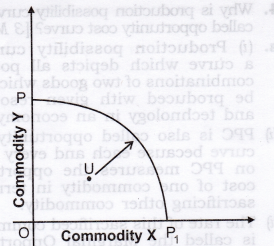

- Production possibility curve is a curve which depicts all possible combinations of two goods which can be produced with given resources and technology in an economy.

- PPC is also called opportunity cost curve because each and every point on PPC measures the opportunity cost of one commodity in terms of sacrificing other commodity.

- The rate of this sacrificed commodity is called the Marginal Opportunity Cost of the expanding good.

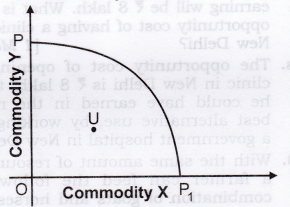

- The Production Possibility Curve shifts to the left.

- It is so because outflow of foreign capital decreases the capital resource in our country leads to fall in production capacity of our country.

- It can be explained with the help of the diagram that PP is at full employment level and due to outflow of foreign capital it shifts leftwards P1P1.

- The economy moves towards the full employment, thereby removes unemployment.

- This can be done when government starts employment generation schemes. By this, economy moves towards full employment and production potentiality of an economy increases.

-

It can be explained with the help of the following diagram. In the given figure,from unemployment (U), we are moving towards full employment (F).

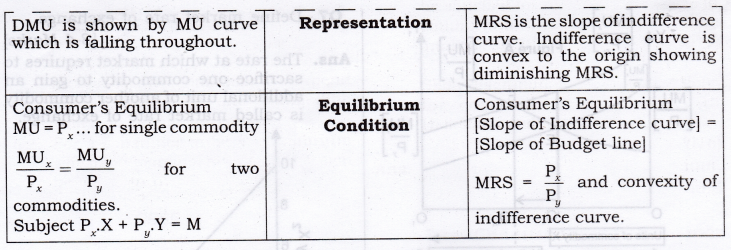

Chapter-2 Consumer Equilibrium

QUESTIONS SOLVED

Question 1. What do you mean by the budget set of a consumer?

Or

Define Budget Set.

Answer: Budget set is the collection of all bundles of goods that a consumer can buy with his income at the prevailing market prices.

Question 2. What is Budget Line?

Answer: Budget line is a graphical representation which shows all the possible combinations of the two goods that a consumer can buy with the given income and prices of commodities. It is also called consumption possibility line.

Question 3. Explain why budget line is downward sloping?

Or

Why is budget line negatively sloped? [CBSE 2011 C][l Mark]

Answer: ‘Budget line is downward sloping because if a consumer wants to buy more of one commodity, he has to buy less of other goods, given money income.

Question 4. A consumer wants to consume two goods. The prices of the two goods are Rs 4 and Rs 5 respectively. The consumer’s income is Rs 20.

- Write down the equation of the budget line.

- How much quantify of good 1 can the consumer consume if she spends her entire income on that good?

- How much of good 2 can she consume if she spends her entire income on that good?

- What is the slope of the budget line? [3-4 Marks]

Answer:

- Let the two quantities of goods be X and Y. We are given Px = Rs 4, P = Rs 5, Consumer’s income (M) = Rs 20. Budget line equation is,

Px .X + Py .Y = M or = 4X + 5Y = 20 - If quantity consumed of good Y = 0, Budget equation becomes,

Px.X + zero = M = 4.X = 20 = X = 20/4 = 5 units - If quantity consumed of good X = 0, Budget equation becomes,

Zero + Py.Y = M

or = 5Y = 20 = Y = 20/5 = 4 units. - Slope of budget line = Px/Py = 4/5 = 0.8

Questions 5, 6 and 7 are related to question 4,

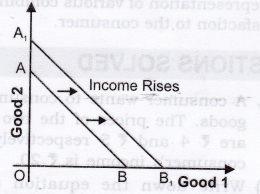

Question 5. How does the budget line change if the consumer’s income increases to ?40 but the prices remain unchanged? [1 Mark]

Answer: If consumer’s income increases to Rs 40, the consumer can buy more pieces/quantities of both the goods X and Y. There will be parallel rightward shift in the budget line AB to A1B1.

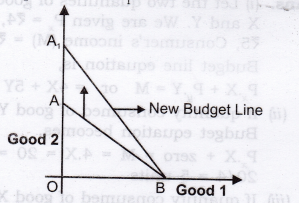

Question 6. How does the budget line change if the price of good 2 decreases by a rupee but the price of good 1 and the consumer’s income remain unchanged? [ 1 Mark]

Answer: If price of good 2 (shown on y-axis) decreases, consumer can buy more pieces /quantity of good 2. The budget line AB will pivot at B and rotate upwards to A1 B.

Question 7. What happens to the budget set if both the prices as well as the income double? [ 1 Mark]

Answer: There will be no change in the budget line. Let us understand this with the help of an example: Suppose,the price of goods 1 rises from Rs 4 to Rs 8 and that of goods 2 rises from Rs 5 to Rs 10. Income also rises from Rs 20 to Rs 40. With double increase in prices and income, intercepts on both X-axis and Y-axis will remain unchanged at 5 units (goods 1) and 4 units (goods 2) respectively. Slope of budget line will also remain the same. Therefore, there will be no change in the budget set and the budget line.

Question 8. Suppose a consumer can afford to buy 6 units of good 1 and 8 units of good 2 if she spends her entire income. The prices of the two goods are Rs 6 and Rs 8 respectively. How much is the consumer’s income? [1 Mark]

Answer: Budget equation is given as: Px.X + Py .Y = M

Let good 1 be X and good 2 be Y Putting the values, we get,

(6).(6) + (8).(8) = 36 + 64 = Rs 100

Question 9. Suppose a consumer wants to consume two goods which are available only in integer units. The two goods are equally priced at Rs 10 and the consumer’s income is Rs 40.

- Write down all the bundles that are available to the consumer.

- Among the bundles that are available to the consumer’s. Identify those which cost her exactly 40.[3-4 Marks]

Answer: Let Px = Py = Rs 10

Money Income = 40

- Bundles available to consumer are: (0,0), (0,1), (0,2), (0,3), (0,4), (1,0), (1,1), (1,2), (1,3), (2,0), (2,1), (2,2), (3,0), (3,1) and (4, 0).

- (0,4), (1,3), (2,2), (3,1) and (4,0) cost exactly Rs 40. All the other bundles cost less than Rs 40.

Question 10. What are monotonic preferences? [AI 2011 C][l Mark]

Answer: Consumer’s preferences are assumed to be such that between any two bundles (x1, x2) and (y1, y2), if (x1, x2) has more of at least one of the good and no less of the other good as compared to (y1, y2), the consumer prefers (x1, x2) to (y1, y2). Preferences of this kind are called monotonic preferences.

Question 11. If a consumer has monotonic preferences, can she be indifferent between the bundles (10, 8) and (8, 6)? [1 Mark]

Answer: No, if a consumer has monotonic preferences, bundle (10, 8) is preferred to bundle (8, 6) as bundle (10, 8) has more units of both the goods.

Question 12. Suppose a consumer’s preferences are monotonic. What can you say about her preference ranking over the bundles (10, 10), (10, 9), (9, 9). [1 Mark]

Answer: If a consumer has monotonic preferences then,

- Bundle (10, 10) is monotonically preferred to bundle (10, 9) and bundle (9, 9).

- Bundle (10, 9) is monotonically preferred to bundle (9, 9).

Question 13. Suppose your friend is indifferent to the bundles (5, 6) and (6, 6). Are the preferences of your friend monotonic? [I Mark]

Answer: No, the preferences of my friend are not monotonic since bundle (6, 6) should be monotonically preferred to bundle (5, 6).

MORE QUESTIONS SOLVED

I. Very Short Answer Type Questions (1 Mark)

Question 1. Define utility. [CBSE 2005C, 06C, AI 06]

Answer: Utility is the power or capacity of a commodity to satisfy human wants.

Question 2. Define total utility.

Answer: Total utility is the sum of all the utilities derived from consumption of all the units of a particular commodity.

Question 3. How much is total utility at zero level of consumption?

Answer: Zero.

Question 4. How is total utility deriveds from marginal utility?

Answer: TU = MU1 + MU2 + MU3 +————- +

Question 5. Define marginal utility. [AI 2006, Foreign 2006]

Answer: Marginal utility is the additional utility derived from consumption of an additional unit of a commodity.

Question 6. What is consumer’s equilibrium? [Foreign 2006, CBSE 2009C, AI 2013C]

Answer: Consumer’s equilibrium refers to a situation where a consumer gets the maximum satisfaction out of his given money income and given market price.

Question 7. What is meant by MU of one rupee?

Answer: MU of one rupee refers to the utility obtained from purchase of commodities with one rupee.

Question 8. Define indifference curve. [AI 2013, 2014, 2015]

Answer: Indifference curve refers to the graphical representation of various combinations of the two goods that provide the same level of satisfaction to a consumer.

Question 9. Define indifference map? [CBSE 2013C, AI 2015]

Answer: A set of indifference curves is called indifference map.

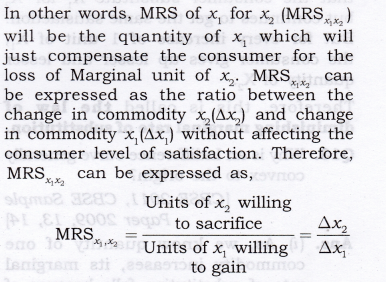

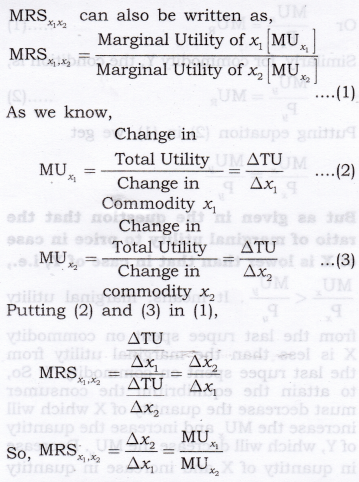

Question 10. Define marginal rate of substitution.

Answer: MRS is the rate at which a consumer is willing to give up one commodity for an extra unit of other commodity without affecting his total satisfaction.

Question 11. Why are indifference curves always convex to the origin?

Answer: Indifference curves are always convex to the origin because of the diminishing marginal rate of substitution.

Question 12. Why does an indifference curve slope downwards?

Answer: An Indifference curve slopes downwards because increase in units of one good requires decrease in the number of units of the other good to maintain the same level of satisfaction.

Question 13. Give equation of Budget Line. [CBSE 2015]

Answer: P1X1 + P2X2 = M.

Question 14. Give equation of Budget Set. [CBSE 2015]

Answer: P1X1 + P2X2 < M.

Question 15. Define Budget Set. [CBSE 2015]

Answer: It is the collection of all bundles of pieces of goods that a consumer can buy with his income at the prevailing market prices.

Question 16. Define Budget Line. [AI 2015]

Answer: Budget line is a graphical representation which shows all the possible combinations of the two goods that a consumer can buy with the given income and prices of commodities.

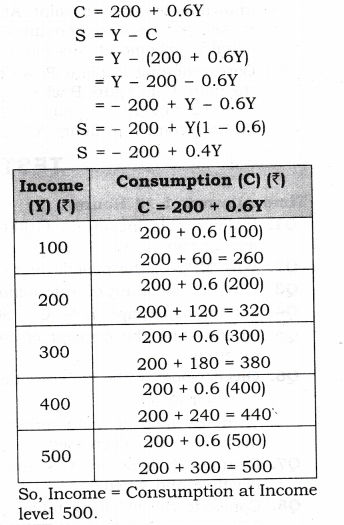

II. Multiple Choice Questions (1 Mark)

Question 1. Total utility is maximum when

(a) Marginal utility is zero.

(b) Marginal utility is at its highest point.

(c) Marginal utility is equal to average utility.

(d) Average utility is maximum.

Answer: (a)

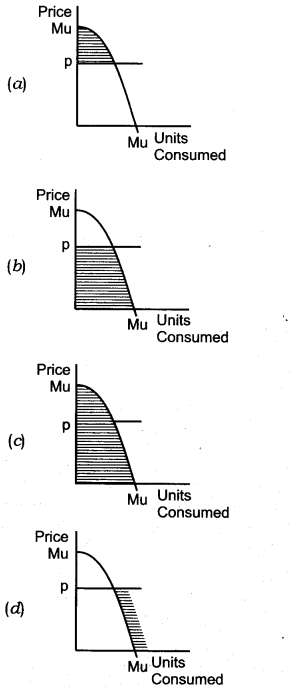

Question 2. Which of the shaded area in the diagrams below represent total utility? [CBSE Sample Paper 2014]

Answer: (c)

Question 3. What does the area under the marginal utility curve depict? [CBSE Sample Paper 2014]

(a) Average Utility

(b) Total Utility

(c) Indifference Curve

(d) Consumer Equilibrium

Answer: (b)

Question 4. Which one of the following is not an assumption of the theory of demand based on analysis of indifference curve?

(a) Given scale of preferences as between different combinations of two goods.

(b) Diminishing marginal rate of substitution.

(c) Constant marginal utility of money.

(d) Consumers would always prefer more of a particular piece of goods to less of it, other things remaining the same.

Answer: (c)

Question 5. The consumer is in equilibrium at a point where the budget line—

(a) Is above an indifference curve.

(b) Is below an indifference curve.

(c) Is tangent to an indifference curve.

(d) Cuts an indifference curve.

Answer: (c)

Question 6. An indifference curve slopes down towards right since more of one commodity and less of another result in—

(a) Same satisfaction.

(b) Greater satisfaction.

(c) Maximum satisfaction.

(d) Decreasing expenditure.

Answer: (a)

Question 7. The second glass of lemonade gives lesser satisfaction to a thirsty boy. This is a clear case of

(a) Law of demand.

(b) Law of diminishing returns.

(c) Law of diminishing utility.

(d) Law of supply.

Answer: (c)

Question 8. The consumer is in equilibrium when the following condition is satisfied:

(a)

(b)

(c)

(d)None of these.

Answer: (c)

Question 9. Which of the following options is a property of an indifference curve?

(a) It is convex to the origin.

(b) The marginal rate of substitution is constant as you move along an indifference curve.

(c) Marginal utility is constant as you move along an indifference curve.

(d) Total utility is the greatest where the 45 degrees line cuts the indifference curve.

Answer: (a)

Question 10. When economists speak of the utility of a certain good, they are referring to-

(a) The demand for the good.

(b) The usefulness of the good in consumption.

(c) The satisfaction gained from consuming the good.

(d) The rate at which consumers are willing to exchange one unit of good for an other one.

Answer: (c)

Question 11. Budget set is—

(a) Right angled triangle formed by the budget line with the axes.

(b) All points on the budget line.

(c) Points inside the budget line.

(d) Points on Y-axis from where budget line starts and the point on X-axis where budget line ends.

Answer: (a)

Question 12. If indifference curve is straight line downward sloping,

(a) MRS is increasing

(b) MRS is decreasing

(c) MRS is constant

(d) MRS is zero

Answer: (c)

Question 13. If X and Y are two commodities, indifference curve shows—

(a) X and Y are equally preferred

(b) Y is preferred to X

(c) X is preferred to Y

(d) None of these.

Answer: (a)

Question 14. If Marginal Rate of Substitution is constant throughout, the Indifference curve will be: [CBSE 2015]

(a) Parallel to the x-axis.

(b) Downward sloping concave.

(c) Downward sloping convex.

(d) Downward sloping straight line.

Answer: (d)

Question 15. If Marginal Rate of Substitution

is increasing throughout, the Indifference curve will be: [AI 2015]

(a) Downward sloping convex.

(b) Downward’ sloping concave.

(c) Downward sloping straight line.

(d) Upward sloping convex.

Answer:(b)

Question 16. Which of the can be referred to as ‘point of satiety’?

(a) Marginal Utility is negative

(b) Marginal utility is zero

(c) Total Utility is rising

(d) Total Utility is falling

[CBSE Sample Paper 2016]

Answer: (b)

III. Short Answer Type Questions (3-4 Marks)

Note: Questions 1, 2 and 3 have same figure.

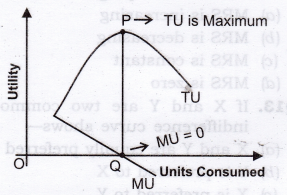

Question 1. Explain with diagram, the relationship between TU and MU. [CBSE Foreign 2011]

Answer:

- When MU decreases, TU increases at a diminishing rate. (As shown in figure till consumption level OQ).

- When MU is zero, TU is constant and maximum at P.

- When MU is negative, TU starts diminishing.

Question 2. How many chocolates will a consumer have, if they are available free of cost?

Answer: In case of free chocolates, consumer will carry on the consumption till his total utility is maximum. It means,till the additional chocolates gives positive satisfaction, consumer will keep on having chocolates. Let us understand this with the help of the figure shown in Question 1. Consumer will stop the consumption at the point of satiety (Point ‘Q’), i.e., where marginal utility is equal to zero.

Question 3. “Total Utility remains the same, whether Marginal Utility is positive or negative”. Defend or refute.

Answer: The given statement is refuted. When Marginal Utility is positive till point Q as shown in figure of Question 1, then total Utility increases at a diminishing rate and when Marginal Utility is negative after point Q, total Utility decreases.

Question 4. State with reasons if the following statements are true or false:

- At a grand family get-together party you go on eating and eating since you have not to pay.

- As we consume more units of a commodity, our total utility from its consumption keeps falling.

Answer:

- False: For free goods, a consumer will limit his consumption of a commodity to a point where the point of full satisfaction is reached. Consumption beyond this point will only generate disutility.

- False: As we consume more units of a commodity, it’s marginal utility keeps on diminishing. Total utility keeps on rising, but at a diminishing rate till marginal utility becomes zero.

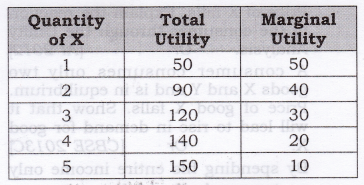

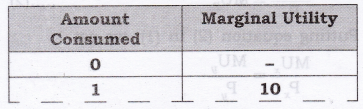

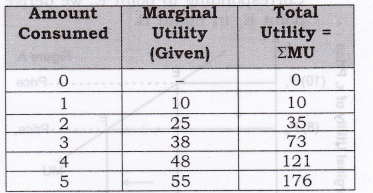

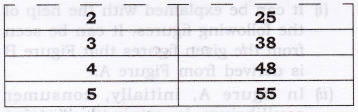

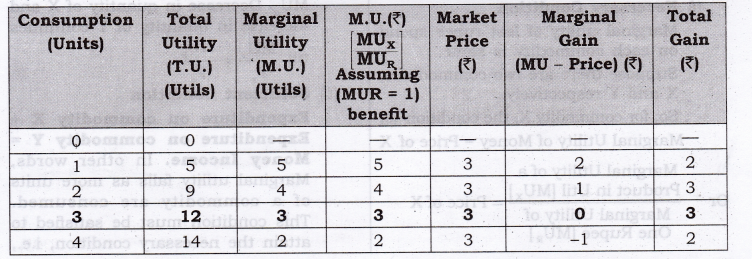

Question 5. Explain the law of diminishing marginal utility with the help of a total utility schedule. [CBSE 2005C, 06C, 10, IOC, AI 2006, CBSE 13]

Answer: The law states that marginal utility derived from the consumption of a commodity declines as more units of that commodity are consumed.

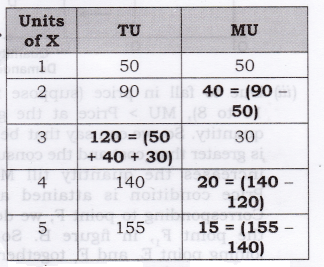

It can be seen from the above schedule that total utility increases at a diminishing rate, which leads to fall in marginal utility.

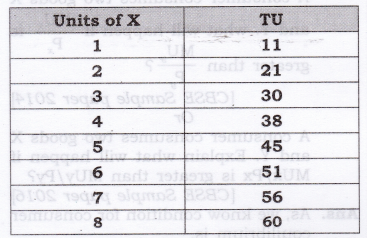

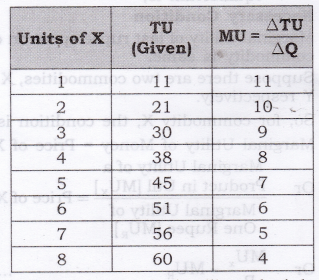

Question 6. Derive MU Schedule from TU Schedule.

Answer:

Question 7. A person’s marginal utility schedule is given below. Derive their total utility schedule.

Answer:

As we know total utility is the sum total of marginal utilities as shown below.

Question 8. Calculate:

Answer:

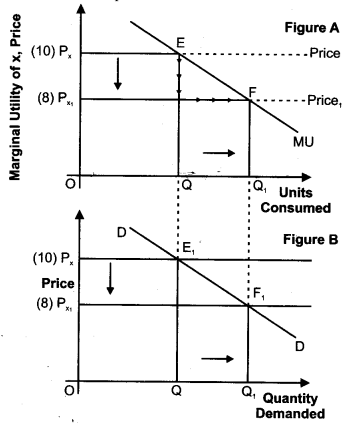

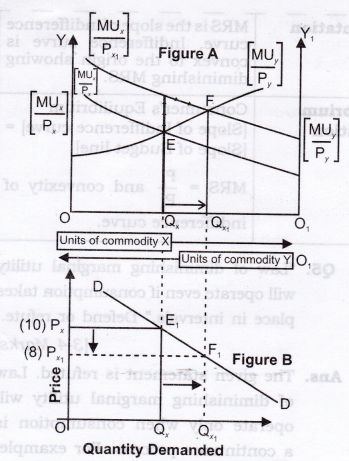

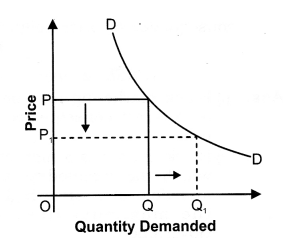

Question 9. Derive the inverse relation between price of the good and its demand from single commodity equilibrium condition “marginal utility = price”. [CBSE Foreign 2011]

Answer: As we know a consumer purchases a good up to the point where marginal utility of the good becomes equal to the price of that good.

MU = Price

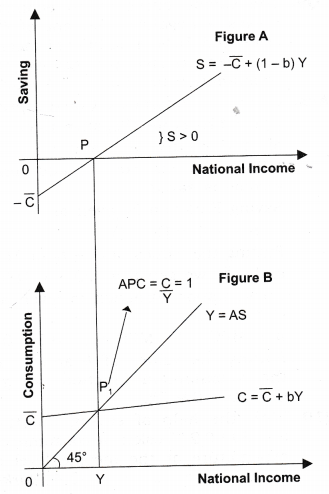

- Figure B is derived from Figure A.

- In figure A, initially, consumer equilibrium is attained at point E, where let MU (10) = Price (10). Corresponding to point E, we derive point E1 in figure B.

- Due to fall in price (suppose from 10 to 8), MU > Price at the given quantity. So, we can say that benefit is greater than cost and the consumer increases the quantity till MU = Price condition is attained at F. Corresponding to point F, we derive the point F1; in figure B. So, by joining point E1 and F1 together, we derive the demand curve.

Question 10. A consumer consumes only two goods X and Y. At a consumption level of these two goods, he finds that the ratio of marginal utility to price in case of X is higher than that in case of Y. Explain the reaction of the consumer. [AI 2011]

Or

A consumer consumes only two goods X and Y and is in equilibrium.

Price of X falls. Explain the reaction of the consumer through the Utility Analysis. Or [AI 2012]

A consumer consumes only two goods X and Y and is in equilibrium. Price of good X falls. Show that it will lead to rise in demand for good X. Or [CBSE 2013C]

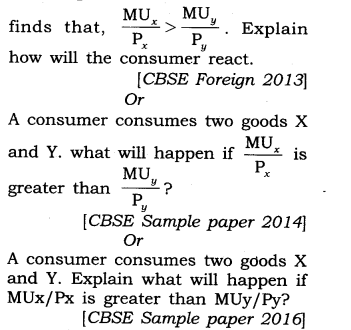

By spending his entire income only on two goods X and Y a consumer

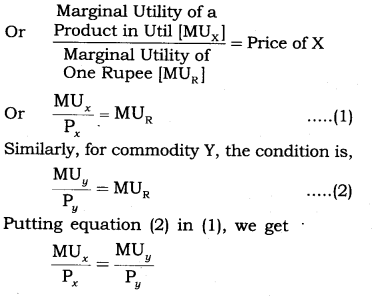

Answer: As, we know condition for consumer equilibrium is,

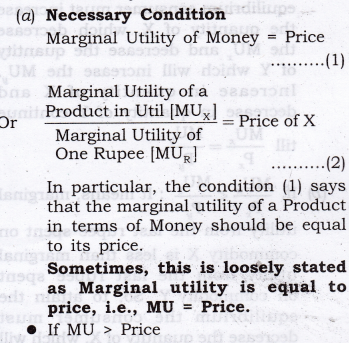

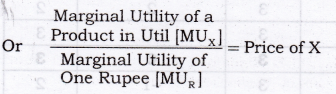

Necessary Condition

Marginal utility of last rupee spent on each commodity is same.

Suppose there are two commodities, X and Y respectively.

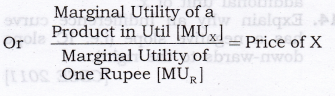

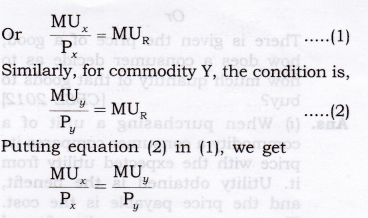

So, for commodity X, the condition is, Marginal Utility of Money = Price of X

But as given in the question that the ratio of marginal utility to price in case of X is higher than that in case of Y,i.e….

It means marginal utility from the last rupee spent on commodity X is more than marginal utility from the last rupee spent on commodity Y. So, to attain the equilibrium consumer must increase the quantity of X, which decreases the MUx and decreases the quantity of Y, which will increase the MUy. Increase in quantity of X and decrease in quantity of Y till

Question 11. A consumer consumes only two goods X and Y. At a certain consumption level of these goods, he finds that the ratio of marginal utility to price in case of X is lower than that in case of Y. Explain the reaction of the consumer. Or [AI2011]

By spending his entire income only on two goods X and Y a consumer finds that,

Or

[CBSE Foreign 2013]

A consumer consumes only two goods X and Y and is in equilibrium. Show that when the price of good X rises, the consumer buys less of good X. Use utility analysis. [AI 2014]

Answer: As, we know condition for consumer equilibrium is, Necessary Condition

Marginal utility of last rupee spend on each commodity is same.

Suppose there are two commodities, X and Y respectively.

So, for commodity X, the condition is, Marginal Utility of Money = Price of X

But as given in the question that the ratio of marginal utility to price in case of X is lower than that in case of Y, i.e.,

It means, marginal utility from the last rupee spent on commodity X is less than the marginal utility from the last rupee spent on commodity Y. So, to attain the equilibrium the consumer must decrease the quantity of X which will increase the MUx and increase the quantity of Y, which will decrease the MU . Decrease in quantity of X and increase in quantity of Y continue till

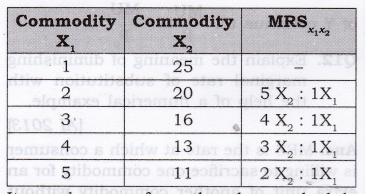

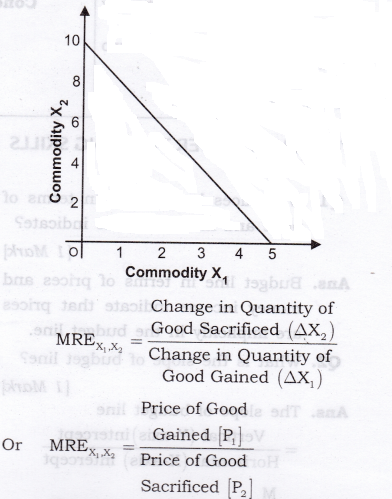

Question 12. Explain the meaning of diminishing marginal rate of substitution with the help of a numerical example. [AI 2013]

Answer: MRS is the rate at which a consumer is willing to sacrifice one commodity for an extra unit of another commodity without affecting his total satisfaction.

It can be seen from the above schedule that the consumer substitute X1 for X2 but continues to get the same satisfaction. But for every increase of 1 unit of X1; the consumer gives up lesser and lesser quantity of X2.

Therefore, this is called the law of diminishing marginal rate of substitution.

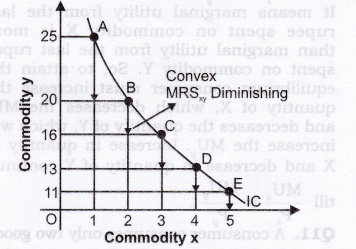

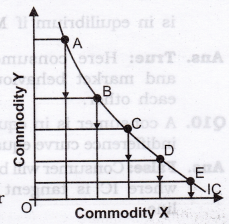

Question 13. Why is an Indifference curve generally , convex to the origin? [CBSE 2011, CBSE Sample Paper 2009, 13, 14]

Answer:

- As, we know quantity of one commodity increases, its marginal rate of substitution falls because of law of diminishing marginal utility. Marginal rate of substitution is a slope of Indifference curve and whenever slope [MRS] decreases it makes the curve convex to the point of origin.

- In the above diagram, units of y are measured on vertical axis and units of x on horizontal axis. When the consumer moves from combination A (1 x + 25y) to B (2x + 20y), he acquires one additional unit of x and forgoes (sacrifice) 5 units of y, if he wants to get the same level of satisfaction. The consumer has to reduce the consumption of y when he increases the consumption of x. The number of units of good y that the consumer is willing to sacrifice for an additional unit of good x, so as to maintain the same level of satisfaction is technically called the marginal rate of substitution of x for y and is denoted by MRSxy .

- So, the MRSxy when the consumer move from combination A to B is 5 : 1, further as the consumer move from combination B to C, he acquires one more units of x, but the consumer forgoes a smaller number of y, i.e., MRSxy at this stage is 4 : 1. It may be observed now that MRS diminishes as the consumer moves from combination A to B, B to C, C to D, D to E. The consumer forgoes less and less units of y as he acquires additional unit of x.

Question 14. Explain why an Indifference curve has a negative slope (i.e. IC slope down-wards to the right). [CBSE 2011]

Answer: Every IC is based on the assumption that various combinations of two commodities gives equal satisfaction to a consumer. In order to remain at the same level of satisfaction, the consumer will have to reduce the consumption of one commodity if he wants to increase the consumption of another commodity.

Question 15. Why do Indifference curves not intersect each other?

Answer:

- Two IC’s cannot intersect each other. This property is proved by Contradict Method. First we assume that they intersect each other and then show that this assumption leads to an absurd conclusion. Let us assume that IC1 intersects IC2 at point E shown in the figure given here.

- Let point A be a point on IC, and point B on IC2. Since A and E lie on IC,, the consumer will be indifferent between points E and A (A = E). Similarly, B and E lie on IC2, the consumer will be indifferent between points E and B (B = E).

- Based on the assumption of transitivity as A = E and B = E, then the consumer must be indifferent between A and B (A = B) but this is not possible as A and B lie on two different ICs and represent different levels of satisfaction. Therefore, IC cannot intersect each other.

Question 16. Explain that Higher IC provides higher level of satisfaction, or

‘Higher indifference curve represents higher level of satisfaction to the consumer’. Explain the statement, also state the underlying assumption related to this property of indifference curve. [CBSE Sample Paper 2016]

Answer:

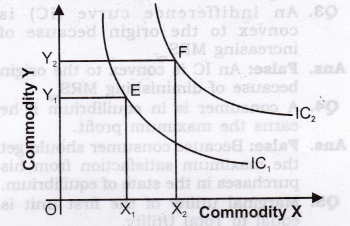

- Higher IC lying above and to the right of another IC represents a higher level of satisfaction. All combinations of goods X and Y lying on the higher indifference curve IC2 have more satisfaction than lower indifference curve IC1 as shown in figure given here.

- This is because of monotonic preferences, as monotonic preferences state that we must have atleast more of one good and no less that of other goods (means other goods can be equal or greater, but not less). The figure above shows that bundle F(OX2 + OY2) is monotonic preferred to bundle E(OX1 + OY1). So, if bundle F is monotonic preferred to bundle E than F bundle gives more satisfaction than that of Bundle E.

- It can be seen from the above diagram that all combinations of IC2 contain a large quantity of both X and Y, than all combinations on IC,. For, e.g., point E lying on IC, represents OX, units of X and OY1 units of Y. Point F lying on IC2 represents more units of Y, i.e., OY, as well as more units of X, i.e. OX2.

The consumer gets greater satisfaction from a larger pieces of goods than from a smaller amount. Hence, point F shall be on a higher IC and shall be more preferable to point E, lying on lower IC.

IV.True Or False

Giving reasons, state whether the following statements are true or false.

Question 1. Total utility increases as long as marginal utility is positive (+).

Answer: True: Because TU is the sum of marginal utilities and MU is positive.

Question 2. TU starts declining when MU starts declining.

Answer: False: Because TU starts declining only when diminishing MU becomes negative.

Question 3. An indifference curve (IC) is convex to the origin because of increasing MRSxy.

Answer: False: An IC is convex to the origin because of diminishing MRS .

Question 4. A consumer is in equilibrium if he earns the maximum profit.

Answer: False: Because consumer should get the maximum satisfaction from his purchases in the state of equilibrium.

Question 5. Marginal utility of the first unit is equal to Total Utility.

Answer: True: MU = TUn – TUn-1 = TU1 – TU0= TU1

Question 6. In case of single commodity, consumer will be in equilibrium when M.U. = Income.

Answer: False: A consumer is in equilibrium when MU = Price.

Question 7. If there are two commodities, consumer is in equilibrium if

Answer: False: A consumer is in equilibrium only when

Question 8. If TU remains the same; MU may be negative or positive.

Answer: False: TU decreases if MU is negative, ‘ and TU increases if MU is positive.

It is constant and maximum only if MU = 0.

Question 9. In case of indifference curve consumer is in equilibrium if

Answer: True: Here consumer’s behaviour and market behaviour match with each other.

Question 10. A consumer is in equilibrium where indifference curve equals budget line?

Answer: False: Consumer will be in equilibrium where IC is tangent to the budget line.

Question 11. All points on the budget line give equal satisfaction to the consumer.

Answer: False: All points on an IC give equal satisfaction.

Question 12. All combinations on an IC are achievable by a consumer.

Answer: False: All the combinations on a budget line are achievable and not points on IC.

Note: As per CBSE guidelines, no marks will be given if reason to the answer is not explained.

V. Long Answer Type Questions (6 Marks)

Question 1. Explain consumer’s equilibrium in case of a single commodity with the help of a utility schedule. [CBSE 2005, 06, 07C, 09, AI 05, 08,Foreign 2009] Or

State condition of consumer equilibrium in case of a single commodity. Or [CBSE 2006]

There is given the market price of a piece of goods, how does a consumer decides as to how many units of that piece of goods to buy. [AI 2008, 09] Or

How many units of a commodity should a consumer buy to get its maximum utility? Explain with the help of a numerical example. [Foreign 2005]

Or

There is given the price of a good, how does a consumer decide as to how much quantity of that goods to buy? [CBSE 2012)

Answer:

- When purchasing a unit of a commodity a consumer compares its price with the expected utility from it. Utility obtained is the benefit, and the price payable is the cost. The consumer compares benefit and the cost. He will buy the unit of a commodity only if the benefit is greater than or at least equal to the cost.

- Equilibrium Conditions for Single Commodity Consumer Equilibrium.

> As a rational consumer he will continue to purchase an additional unit of a commodity as long as MU = Price.

> MU > Price implies benefit is greater than cost and whenever benefit is greater than cost, the consumer keeps on consuming additional unit of a commodity till MU = Price.

> It is so because according to the law of diminishing marginal utility MU falls as more is purchased. As MU falls it is bound to become equal to the price at some point of purchase.

• If MU< Price

> As a rational consumer he will have to reduce the consumption of a commodity as long as MU = Price.

> MU < Price implies when benefit is less than cost, and whenever benefit is less than cost the consumer keeps on decreasing the additional unit of a commodity till MU = Price.

> It is so because according to the law of diminishing marginal utility, MU rises as less units are consumed. As MU rises, it is bound to become equal to the price at some point of purchase.

(b) Sufficient Condition: Total gain falls as more is purchased after equilibrium. It means that consumer continues to purchase so long as total gain is increasing or at least constant. - It can be explained with the help of the following schedule:

(a) Suppose, the price of commodity X in the market is Rs3 per unit. It means he has to pay ?3 per unit for all the units he buys. Suppose, the utility obtained from the first unit is 5 utils (= Rs5). The consumer will buy this unit because the utility of this unit is greater than the price and this process continues till Marginal utility = Price as shown in the above schedule at quantity 3.

(b) Consumer will not buy the fourth unit because utility of this unit is 2 units (= Rs2) which is less than the price. It is not worth buying the fourth unit. The consumer will restrict his purchase to only 3 units.

Question 2. A consumer consumes only two goods. Explain the conditions of the consumer’s equilibrium with the help of Utility Analysis.

[CBSE Sample Paper 2013] Or

State and explain the condition of consumer’s equilibrium in case of two commodities through utility approach.[CBSE 2009C, Foreign 2005, 2010]

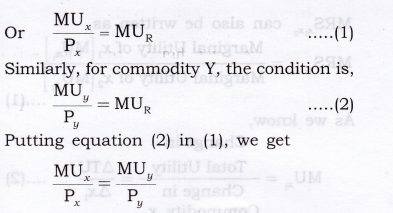

Answer: According to the two commodity consumer equilibrium or law of Equimarginal utility, a consumer gets maximum satisfaction, when ratios of MU of two commodities and their respective prices are equal. Conditions of Consumer’s Equilibrium in case of two commodities

- Necessary Condition

Marginal utility of last rupee spend on each commodity is same. Suppose there are two commodities, X and Y respectively.

So, for commodity X, the condition is, Marginal Utility of Money = Price of X

(a) IfMUxPx>MUyPy : It means, marginal utility from the last rupee spent on commodity X is more than marginal utility from the last rupee spent on commodity Y. So, to attain the equilibrium consumer must increase the quantity of X, which decrease the MUx and decrease the quantity of Y which will increase the MUy .Increase in quantity of X and decrease in quantity of Y continue tillMUxPx=MUyPy

(b) If,MUxPx<MUyPy

It means, marginal utility from the last rupee spent on commodity X is less than marginal utility from the last rupee spent on commodity Y. So, to attain the equilibrium the consumer must decrease the quantity of X, which will increase the MUx and increase the quantity of Y, which will decrease the MUy. Decrease in quantity of X and increase in quantity of Y continues tillMUxPx=MUyPy - Sufficient Condition

Expenditure on commodity X + Expenditure on commodity Y = Money Income. In other words, Marginal utility falls as more units of a commodity are consumed. This condition must be satisfied to attain the necessary condition, i.e.,MUxPx=MUyPy .If MU does not fail as consumption of a commodity increases, the consumer will spend all his income on one commodity, which is highly unrealistic.

Question 3. For a consumer to be in equilibrium why must marginal rate of substitution be equal to the ratio of prices of the two goods? [CBSE Sample Paper 2009] Or

Using indifference curve approach, explain the conditions of consumer’s equilibrium. [CBSE 2010, IOC, 11C, Foreign 2010, AI 11]

Or

Why is the consumer in equilibrium when he buys only that combination of the two goods that is shown at the point of tangency of the budget line with an indifference curve? Explain. [CBSE Sample Paper 2009] Or

What are the conditions of consumer’s equilibrium under the indifference curve approach? What changes will take place if the conditions are not fulfilled to reach equilibrium? Or [Al 2010]

State and explain the conditions of consumer’s equilibrium in indifference curve analysis. [CBSE 2013, C]

Or

Explain consumer equilibrium using the concept of budget line and indifference map or Interior Optimum Consumer Equilibrium.

Or

A consumer consumes only two of goods. For the consumer to be in equilibrium why must Marginal Rate of Substitution between the two goods must be equal to the ratio of prices of these two goods? Is it enough to ensure equilibrium?

[CBSE Sample Paper 2013] Or

A consumer consumes only two goods. Explain the conditions that need to be satisfied for the consumer to be in equilibrium under indifference curve analysis. [CBSE Sample Paper 2014] Or

Show diagrammatically the conditions for consumer’s equilibrium, in Hicksian analysis of demand. [CBSE Sample Paper 2016]

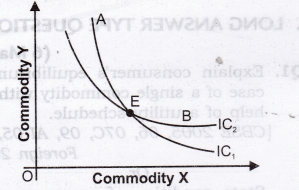

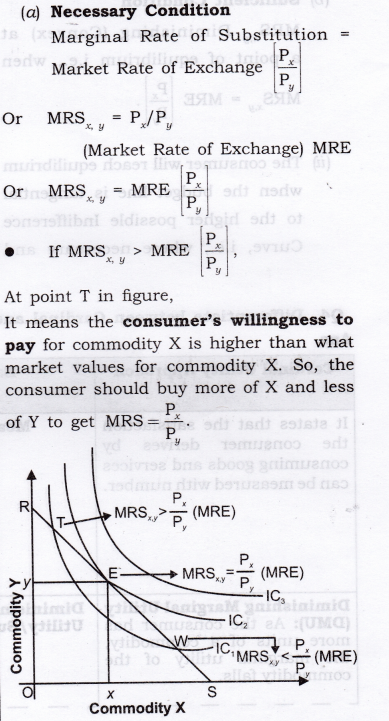

Answer: (i) To define consumer equilibrium, we use Indifference Curve map and the budget line.

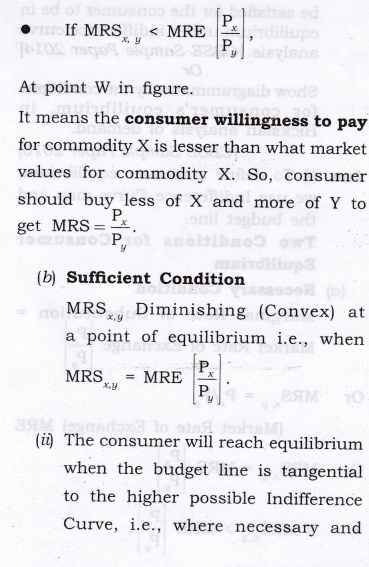

Two Conditions for Consumer Equilibrium

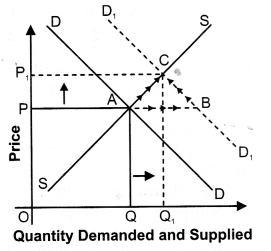

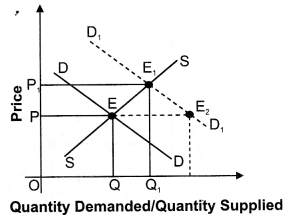

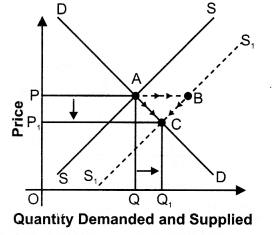

sufficient conditions satisfy. In the above diagram, the consumer will reach equilibrium at point E where budget line RS is tangential to the highest possible IC2.

(iii) The consumer cannot move to Indifference Curve, i.e., IC3 as this is beyond his money income.

(iv) Even on IC2, all the other points except E are beyond his means.

(v) Hence, at point E, the consumer is in equilibrium where his satisfaction maximizes, given his income and prices of goods X and Y. In equilibrium at E, the slope of Budget line = the slope of Indifference Curve. Therefore, MRSxy is equal to the ratio of the prices of two goods

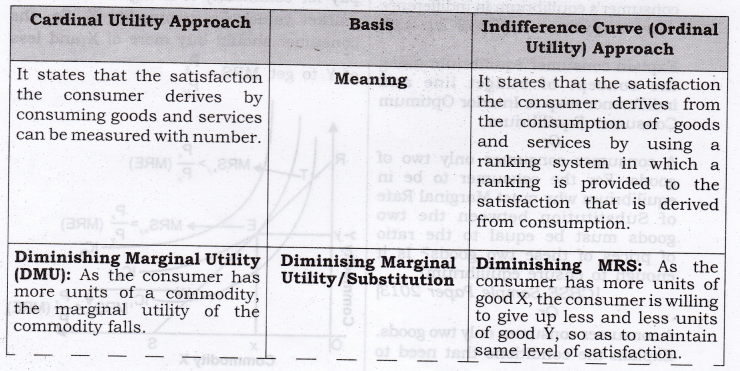

Question 4. Differentiate between Cardinal and Ordinal Utility. [AI 2012]

Answer:

VI. Higher Order Thinking Skills (Hots)

Question 1. What does budget line in terms of price and money income indicate? [1 Mark]

Answer: Budget line in terms of prices and money income indicate that prices are implicitly in the budget line.

Question 2. What is the slope of budget line? [1 Mark]

Answer: The slope of budget line

Question 3. What is the horizontal (X-axis) intercept of budget line? [J Mark]

Answer: Horizontal intercept of budget line

Question 4. What is the Vertical (Y-axis) intercept of budget line?

Answer. Vertical intercept of budget line

Question 5. “Law of diminishing marginal utility will operate even if consumption takes place in intervals.” Defend or refute. [3-4 Marks]

Answer: The given statement is refuted. Law of diminishing marginal utility will operate only when consumption is a continuous process. For example, if one sandwich is consumed in the morning and another in the afternoon, the second sandwich may provide equal or higher satisfaction as compared to the first one.

Question 6. Derive the law of demand from the two commodity equilibrium condition “Marginal Utility = price ratio through utility approach”. [3-4 Marks]

Answer:

- The law states that a consumer is in equilibrium when the ratio of MU to price in case of each good consumed is the same. In of goods, X and Y, a consumer is in equilibrium when,

MUxPx=MUyPy . - Given that the consumer is in equilibrium and price of X falls. It can be seen from the figures that Figure B is derived from Figure A.

- In figure A, initially, the consumer equilibrium is attained at point E,where

MUxPx=MUyPy (Assuming, Px =10). Corresponding to point E, we derive point E1 in figure B. - Due to fall in price (suppose from 10 to 8),

MUxPx>MUyPy ,at the given quantity Qx. It means, marginal utility from the last rupee spent on commodity X is more than marginal utility from the last rupee spent on commodity Y. So, to attain the equilibrium the consumer must increase the quantity of X, which decreases the MUx and decreases the quantity of Y, which will increase the MUy. Increase in quantity of X and decrease in quantity of Y continueMUxPx=MUyPy and the new consumer equilibrium will be attained at point F. Corresponding to point F, we derive the point F1, in figure B. So, by joining point E1 and F1, we derive the demand curve.

Question 7. Define market rate of exchange. [3-4 Marks]

Answer: The rate at which market requires to sacrifice one commodity to gain an additional unit of another commodity is called market rate of exchange.

VII. Value Based Questions

Question 1. How is the law of diminishing marginal utility applied with regard to education/ knowledge? [1 Mark]

Answer: In this case the law of diminishing marginal utility will not apply because every effort to get education/ knowledge increases the utility. Value: Analytic

VIII. Application Based Questions

Question 1. A consumer has Rs 10, and both goods X and Y are priced at Rs 2 and are available in integer units, (a) give the bundles that this consumer can afford to buy (bj give the bundles that cost exactly Rs 10 (c) give two bundles that this consumer cannot afford to buy. [3-4 Marks]

Answer: (a) The bundles that this consumer can afford to buy,

(0,0), (0,1), (0,2), (0,3), (0,4), (0,5),

(1.0), (1,1), (1,2), (1,3), (1,4), (2,0),

(2.1), (2,2), (2,3), (3,0), (3,1), (3,2), (4,0), (4,1) and (5,0).

(b) Bundles that cost exactly ?10 are, (0,5), (1,4), (2,3), (3,2), (4,1), (5,0).

(c) Two bundles that the consumer cannot afford to buy are, (3, 3), (4, 2).

Question 2. A consumer has Rs 40 and both goods X and Y are priced at Rs 20 and are available in integer units, (a) Give the bundles that this consumer can afford (b) give the bundles that cost exactly Rs 40. [3-4 Marks]

Answer: (a) Affordable bundles are, (0,0), (0,1),(0,2),(1,0),(1,1),(2,0).

(b) Bundles that cost exactly Rs 40 are, (0, 2), (1, 1), (2, 0).

Question 3. Give reasons for the following statements: [3-4 Marks]

- If the income of a consumer changes and prices of the two goods remain unchanged, a new budget line will be formed which will be parallel to the original line.

- If the income of the consumer remains unchanged and if the price of goods X rises, intercept of the budget line of Y-axis will remain the same, but on the X-axis it will shift to the left.

Answer:

- As we know, slope of budget line is Px (i.e. price ratio of two goods) with the increase in income. remains constant and only ability to purchase quantities of both commodity X and commodity Y increases. Hence, the budget line shift parallel to the right because when slope is same, than curve should be parallel.

- In this case, the price ratio between X and Y changes. Since the price of X rises, the consumer is in a position to purchase lesser quantity of X while his ability to purchase Y remains unchanged.

Question 4. Giving reasons, comment on the following statements: [3-4 Marks]

- A consumer’s equilibrium is always formed at a point on the given budget line.

- A consumer’s equilibrium will shift to a higher indifference curve with an increase in consumer’s income.

Answer:

- Budget line shows all possible combinations of the two goods that a consumer can buy, given income and prices of commodities. Any other combination lying to the right of this line will be unreachable. Any combination lying to the left of this line results in non-spending of his income.

- Higher income means an increase in a consumer’s ability to purchase increased quantity of both the goods, represented by a rightward shift of the budget line. The new budget line will form a tangent to a higher indifference curve.

Question 5. Giving reasons, state why the following two conditions must be satisfied when a consumer is in equilibrium. [3-4 Marks]

- A budget line must be tangent to an indifference curve.

- Marginal rate of substitution must be diminishing.

Answer:

- Only when the budget line is tangent to an indifference curve, it indicates the highest level of satisfaction that a consumer can attain given his money income and the prices of two commodities.

- Diminishing marginal rate of substitution ensures that the indifference curve is convex to the origin. Only then the point of tangency becomes the point of consumer’s equilibrium.

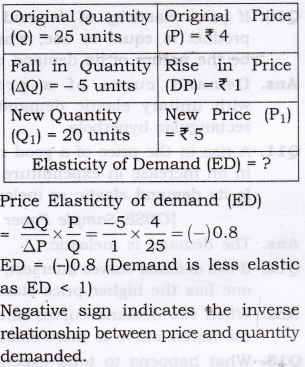

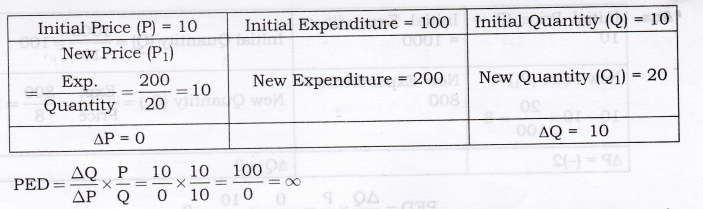

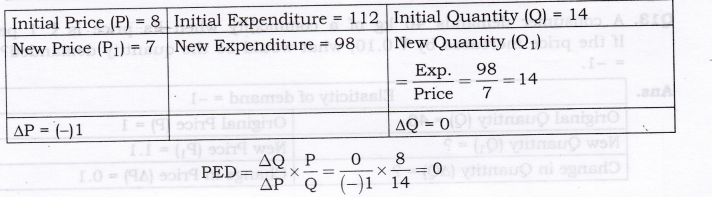

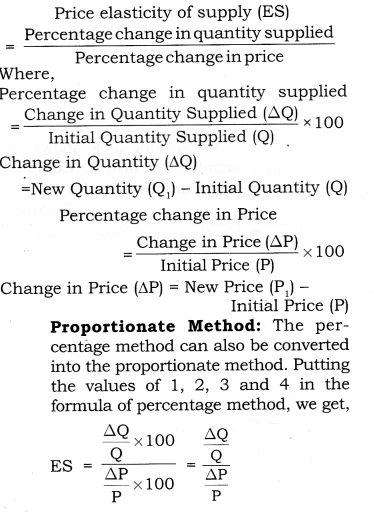

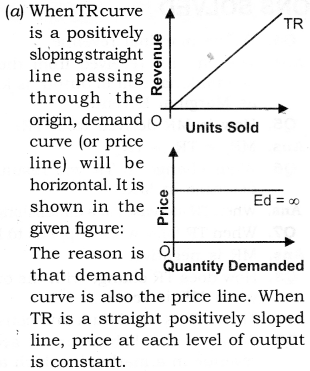

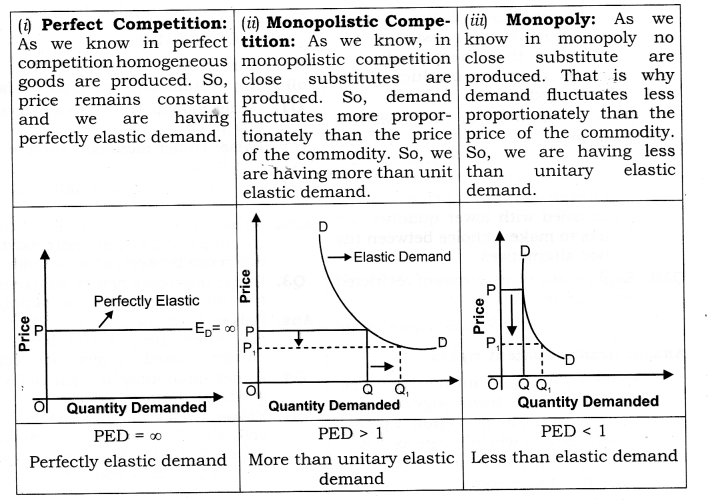

Class 12 Micro Economics Chapter-4 Elasticity of Demand

Question 1. Explain price elasticity of demand.

Answer: The degree of responsiveness of quantity demanded to changes in price of commodity is known as price elasticity of demand.

Question 2. Consider the demand for a good. At price Rs 4, the demand for the good is 25 units. Suppose price of the good increases to Rs 5, and as a result, the demand for the good falls to 20 units. Calculate the price elasticity? [3-4 Marks]

Answer:

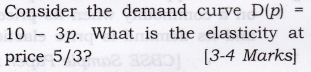

Question 3.

Answer:

Negative Sign of ED indicates that inverse relationship between price and quantity demanded.

PED = 1 [Unitary elastic demand].

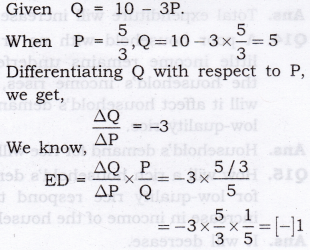

Question 4. Suppose the price elasticity of demand for a good is -0.2. If there is a 5% increase in the price of the good, by what percentage will the demand for the good go down?[3-4 Marks]

Answer:

Question 5. Suppose the price elasticity of demand for a good is -0.2. How will the expenditure on the good be affected if there is a 10% increase in the price of the good? [1 Mark]

Answer: Total expenditure will rise if there is 10% rise in the price of the good since its demand is inelastic (Given ED = 0.2).

Question 6. Suppose, there was 4% decrease in the price of a good and as a result, the expenditure on the goods increased by 2%. What can you say about the elasticity of demand? [1 Mark]

Answer: As total expenditure has increased with a decrease in price, the demand is said to be highly elastic.

MORE QUESTIONS SOLVED

I. Very Short Answer Type Questions (1 Mark)

Question 1. Define price elasticity of demand.

Answer: The degree of responsiveness of quantity demanded to changes in price of the commodity is known as price elasticity of demand.

Question 2. Why is price elasticity of demand has negative sign always?

Answer: Price elasticity of demand is generally negative because of the inverse relationship between price and quantity demanded.

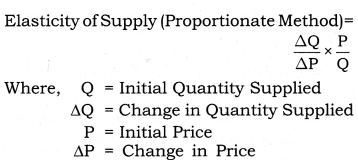

Question 3. Give the formula for measuring price elasticity of demand according to percentage method.

Answer: Elasticity of demand (ED)

Percentage change in quantity demanded Percentage change in price

Question 4. Give the formula for measuring price elasticity of demand according to point method.

Answer: Elasticity of demand (ED)

Lower Segment of demand curve (LS)

Upper Segment of demand curve (US)

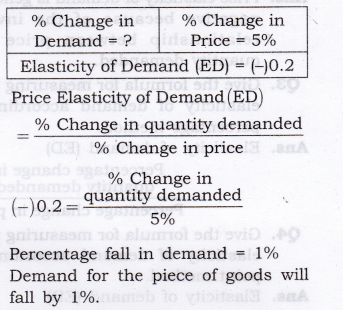

Question 5. Define perfectly inelastic demand.

Answer: If price changes, and quantity demand remains constant, ed = 0 and the result is known as perfectly inelastic demand.

Question 6. Define perfectly elastic demand.

Answer: If quantity demand changes and price remains constant, ed = o and the result is known as perfectly elastic demand.

Question 7. Demand for product X is perfectly ! elastic. What will be the change in price if demand rises from 50 per unit to 70 per unit?

Answer: There will be no change in price as demand is perfectly elastic.

Question 8. If ED < 1, in which portion the point would be located on a straight line demand curve?

Answer: In the lower half.

Question 9. When is the demand of a commodity said to be inelastic? [CBSE Sample Paper 2010]

Answer: When percentage change in the quantity demanded is less than percentage change in price, demand for such a commodity is said to be less elastic.

Question 10. If price elasticity of demand for a product is equal to one, what will be the nature of its demand curve?

Answer: Demand curve of a product with unitary elastic demand is a rectangular hyperbola.

Question 11. A rise in the price of a good results in an increase in expenditure on it. Is its demand elastic or inelastic? [CBSE Sample Paper 2008}

Answer: The demand is inelastic.

Question 12. If two demand curves intersect, which one has the higher price elasticity?

Answer: When two demand curves intersect, the flatter curve is more elastic.

Question 13. What happens to total expenditure on a commodity when its price falls and its demand is price elastic? [CBSE Sample Paper 2010}

Answer: Total expenditure will increase.

Question 14. A poor household with no or very little income remains underfed. If the household’s income rises, how will it affect household’s demand for low-quality rice.

Answer: Household’s demand for rice will rise.

Question 15. How will a rich household’s demand for low-quality rice respond to an increase in income of the household?

Answer: It will decrease

Multiple Choice Questions (1 Mark)

Question 1. In case of a straight-line demand curve meeting the two axes, the price- elasticity of demand at the midpoint of the line would be:

(a) 0 (b) 1 (c) 1.5 (d) 2

Answer: (b)

Question 2. Identify the factor which generally keeps the price elasticity of demand for a good low:

(a) Variety of uses for that good.

(b) Its low price.

(c) Close substitutes for that good.

(d) High proportion of the consumer’s income spent on it.

Answer: (b)

Question 3. Identify the coefficient of price elasticity of demand when the percentage increase in the quantity of good demanded is smaller than the percentage fall in its price:

(a) Equal to one.

(b) Greater than one.

(c) Smaller than one. (d) Zero.

Answer: (c)

Question 4. If the demand for a good is inelastic, an increase in its price will cause the total expenditure of the consumers of the good to:

(a) remain the same, (b) increase.

(c) decrease. (d) Any of these.

Answer: (b)

Question 5. Which one of the following four possibilities, results in an increase in total consumer expenditure?

(a) Demand is unitary elastic and price falls.

(b) Demand is elastic and price rises.

(c) Demand is inelastic and price falls.

(d) Demand is inelastic and price rises.

Answer: (d)

Question 6. The price elasticity of demand for hamburger is:

(a) the change in the quantity demanded of hamburger when the hamburger increases by 30 paise per rupee.

(b) the percentage increase in the quantity demanded of hamburger when the price of hamburger falls by 1 per cent per rupee.

(c) the increase in the demand for hamburger when the price of hamburger falls by 10 per cent per rupee.

(d) the decrease in the quantity demanded of hamburger when the price of hamburger falls by 1 per cent per rupee.

Answer: (b)

Question 7. The price elasticity of demand is defined as the responsiveness of:

(a) price to a change in quantity demanded.

(b) quantity demanded to a change in price.

(c) price to a change in income.

(d) quantity demanded to a change in income.

Answer: (b)

Question 8. A decrease in price will result in an increase in total revenue if:

(a) the percentage change in quantity demanded is less than the percentage change in price.

(b) the percentage change in quantity demanded is greater than the percentage change in price.

(c) demand is inelastic.

(d) the consumer is operating along a linear demand curve at a point at which the price is very low and the quantity demanded is very high.

Answer: (b)

Question 9. An increase in price will result in an increase in total revenue if:

(a) The percentage change in quantity demanded is less than the percentage change in price.

(b) The percentage change in quantity demanded is greater than the percentage change in price.

(c) Demand is elastic.

(d) The consumer is operating along a linear demand curve at a point at which the price is very high and the quantity demanded is very low.

Answer: (a)

III. Short Answer Type Questions

Question 1. Differentiate between perfectly elastic and perfectly inelastic demand. [3-4 Marks]

Answer:

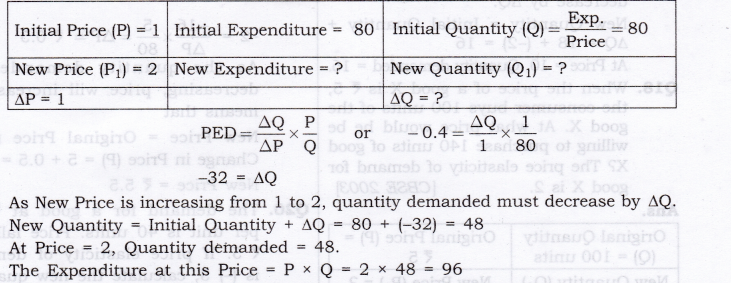

Numerical Problems on Price Elasticity of Demand to Calculate PED

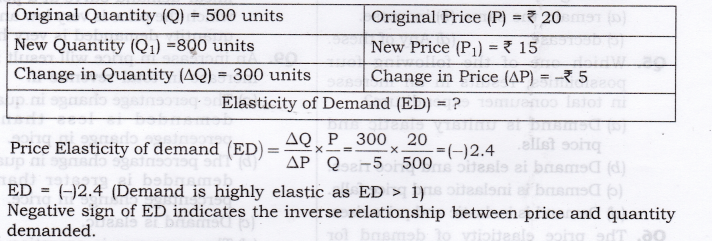

Question 2. When price is Rs. 20 per unit, demand for a commodity is 500 units. As the price falls to Rs. 15 per unit, demand expands to 800 units. Calculate elasticity of demand.

Answer:

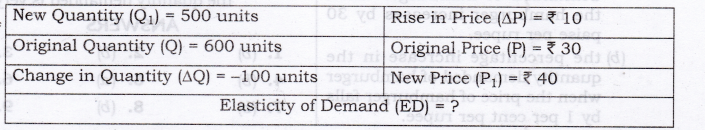

Question 3. The demand for a goods falls to 500 units in response to rise in price by Rs. 10. If the original demand was 600 units at the price of Rs. 30, calculate price elasticity of demand.

Answer:

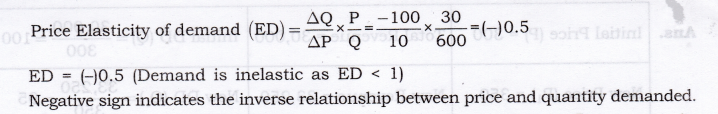

Question 4. A consumer spends Rs. 80 on a commodity when price is Rs. 1 per unit. If the price increases by Rs. 1, his expenditure becomes Rs. 96. Comment on PED.

Answer:

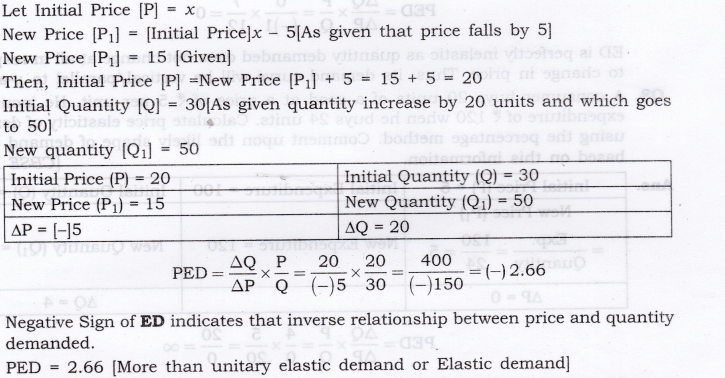

Question 5. A decline in the price of good X by Rs. 5 causes an increase in its demand by 20 units to 50 units. The new price is X 15. Calculate elasticity of demand.

Answer:

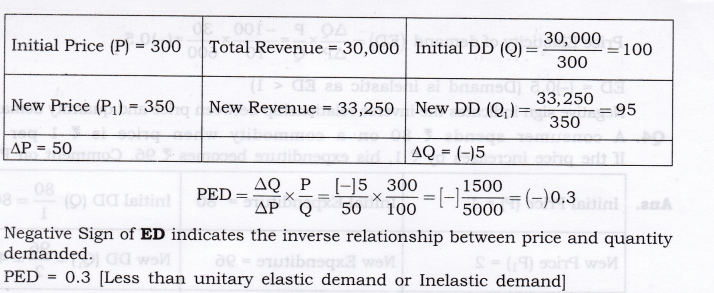

Question 6. A dentist was charging Rs. 300 for a standard cleaning job, and per month it used to generate total revenue equal to Rs. 30,000. She has increased the price of dental cleaning to Rs. 350 since last month. As the result of, few customers are now coming for dental clearing, but the total revenue is now Rs. 33,250. From this, what can we conclude about the elasticity of demand for such a dental service. Calculate PED by proportionate method.

Answer:

Question 7. Negative Sign of ED indicates the inverse relationship between price and quantity demanded. PED = 0.3 [Less than unitary elastic demand or Inelastic demand]

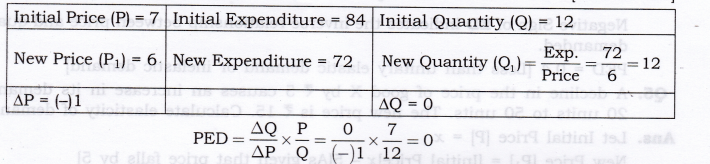

When price of a good is Rs. 7 per unit, a consumer buys 12 units. When price falls to Rs. 6 per unit he spends Rs. 72 on the good. Calculate price elasticity of demand by using the percentage method. Comment on the likely shape of demand curve based on this measure of elasticity. [CBSE 2012]

Answer:

ED is perfectly inelastic as quantity demanded does not change at all in response to change in price. Thus, its demand curve will be vertical/parallel to y-axis.

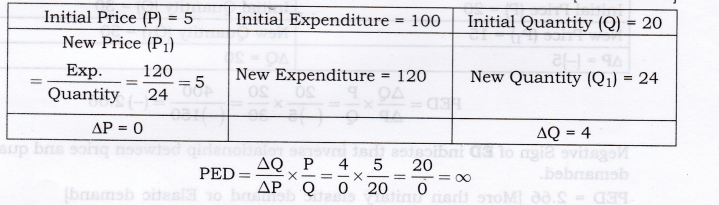

Question 8. A consumer buys 20 units of a good at a price of Rs. 5 per unit. He incurs an expenditure of Rs. 120 when he buys 24 units. Calculate price elasticity of demand using the percentage method. Comment upon the likely shape of demand curve based on this information. [CBSE 2012]

Answer:

ED is perfectly elastic as price does not change at all in response to change in quantity demanded. Thus, its demand curve will be horizontal/parallel to x-axis.

Question 9. A consumer buys 10 units of a commodity at a price of Rs. 10 per unit. He incurs an expenditure of Rs. 200 on buying 20 units. Calculate price elasticity of demand by the percentage method. Comment upon the shape of demand curve based on this information. [AI 2012]

Answer:

Question 10. ED is perfectly inelastic as quantity demanded does not change at all in response to change in price. Thus, its demand curve will be vertical/parallel to y-axis. A consumer spends Rs.1000 on a good priced at Rs.10 per unit. When its price falls by 20 per cent, the consumer spends Rs.800 on the good. Calculate the price elasticity of demand by the Percentage method. [AI 2015]

Answer:

ED is perfectly inelastic as quantity demanded does not change at all in response to change in price. Thus, its demand curve will be vertical/parallel to y-axis.

Numerical Problems to Calculate Price or Quantity (When Price Elasticity of Demand is given)

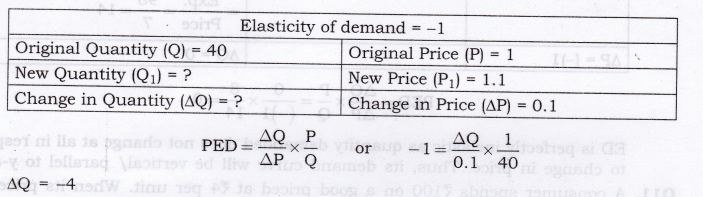

Question 11. A consumer demands 40 kg of a commodity when its price is Rs. 1 per kg. If the price increases by Rs. 0.10, what would be the quantity demanded? PED = -1.

Answer:

As, price is increasing, then quantity demanded must decrease by 4.

So, New Quantity = Initial quantity + AQ = 40 + (-4) = 36

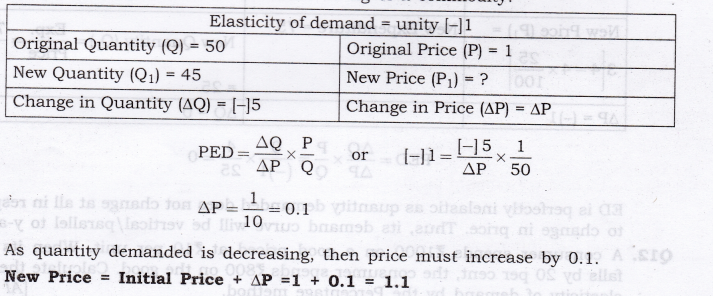

Question 12. PED = [-] 1. A consumer demands 50 units of a commodity when price is Rs 1 per unit. At what price will he demands 45 kg of a commodity?

Answer:

Question 13. A consumer spends Rs. 80 on a commodity when price is Rs 1 per unit. If the price increases by ?1, what would be his expenditure. PED = -0.4?

Answer:

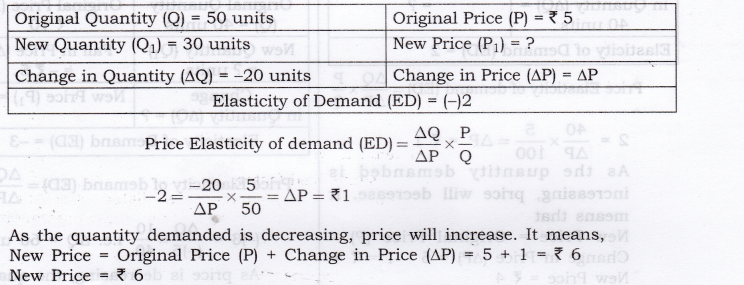

Question 14. The market demand for a good at Rs. 5 per unit is 50 units. Due to increase in price, the market demand falls to 30 units. Find out the new price if the price elasticity of demand is (-)2.

Answer:

As the quantity demanded is decreasing, price will increase. It means,

New Price = Original Price (P) + Change in Price (AP) = 5 + 1 = Rs. 6 New Price = Rs. 6 v

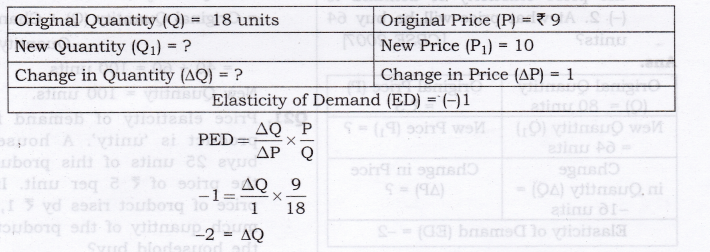

Question 15. A consumer buys 18 units of a good at a price of Rs 9 per unit. The price elasticity of demand for the good is (-)l. How many units the consumer will buy at a price of Rs 10 per unit? Calculate. [CBSE 2014]

Answer:

Class 12 Micro Economics Chapter-5 Production

QUESTIONS SOLVED

Question 1. Explain the concept of a production function. [CBSE 2004C, 07, 09C; AI 05, 08, 11] [1 Mark]

Answer: The relationship between physical input and physical output of a firm is generally referred to as production function.

The general form of production

function is, q = f (x1 : x2)

where, q = output, x1 = 1 input like labour, x2 = another input like machinery

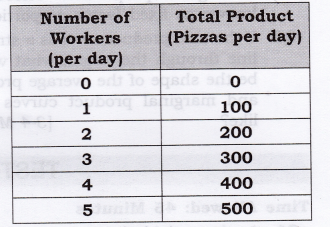

Question 2. What is the total product of an input? [ 1 Mark]

Answer: Total product of an input refers to total volume of goods and services produced by a firm with the given inputs during a specified period of time.

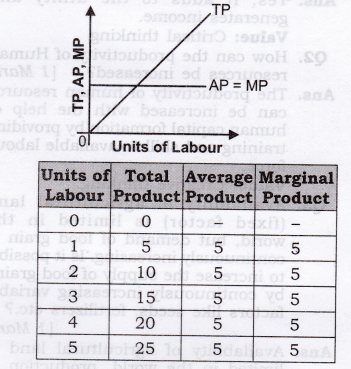

Question 3. What is the average product of an input? [AI 2013,Q] [1 Mark]

Answer: Average Product of am input is per unit product of variable factors. It is calculated by dividing the total Product by the units of variable factor.

Average Product =

Question 4. ‘What is the marginal product of an input? [AI 2005, 13C; 07; CBSE 2005, 06, 06C] [1 Mark]

Answer: Marginal Product of an input is an addition to the total product when an additional unit of a variable factor is employed.

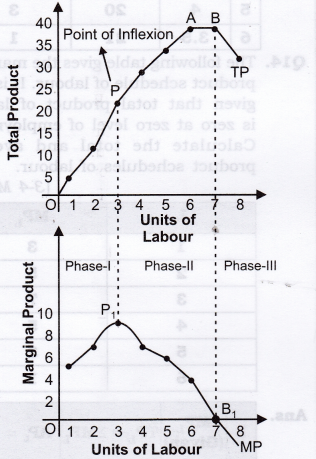

Question 5. Explain the relationship between the marginal products and the total product of an input.

Or [AI 05, 07; CBSE 05, 06, 07] Explain the law of variable proportion with the help of total product and marginal product curves.

[CBSE 2010, 2013] Or

Explain the likely behaviour of Total Product and Marginal Product when for increasing production only one input is increased while all other inputs are kept constant.

[CBSE Sample Paper 2010] [6 Marks] Or

State the different phases of changes in Total Product and Marginal Product in the Law of Variable Proportions. Also show the same in a single diagram. [CBSE 2015]

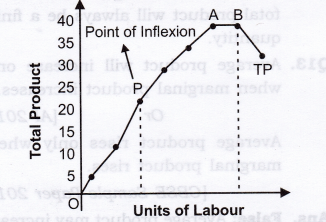

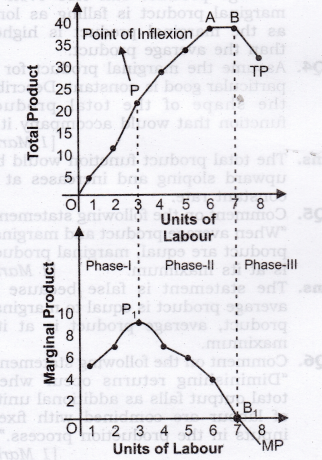

Answer: According to the Law of Variable Proportion when only one input is increased while all other inputs are kept constant, Marginal Product and Total Product behave in the following manner:

- When Marginal product rises (till Point P1), Total product increases at an increasing rate (convex shape) (till point P).

- When Marginal product falls and remains positive (Till point B1), total product increases at a diminishing rate (concave shape) (till point A),

- When Marginal Product is zero (at point B1), Total Product is at its maximum and constant (At point B),

- When Marginal product becomes negative (after point B1), total product falls (after point B).

Question 6. Explain the concepts of the short run and the long run. [3-4 Marks]

Answer:

- Short run:

(a) A short run refers to the period of time in which a firm cannot change some of its factors like plant, machinery, building, etc. due to insufficiency of time but can change any variable factor like labour, raw material, etc.

(b) Thus, in short run, there will be some factors of production that are fixed at predetermined levels, e.g., a farmer may have fixed amount of land, - Long run:

(a) A long run is a time period during which a firm can change all its factors of production including machines, building, organization, etc.

(b) In other words, it is a period of time during which supplies can adjust itself to change in demand.

Note:

(i) Mind, here the terms long run and short run are functional and do not refer to a calendar month or a year,

(ii) This distinction depends merely upon how quickly factor inputs can be change by producers in an industry.

Question 7. What is the law of diminishing marginal product? [I Mark]

Answer: The Law of diminishing marginal product states that when we applied more and more units of variable factor to a given quantity of fixed factor, total product increases at a diminishing rate and marginal product falls.

Question 8. What is the law of variable proportions?

Or

Define the law of variable proportion. [CBSE 2004, 06[[1 Mark]

Answer: The law of variable proportion states that as we increase the quantity of only one input, keeping other inputs fixed, the total product increases at an increasing rate in the beginning, then increases at decreasing rate and after a level the output ultimately falls.

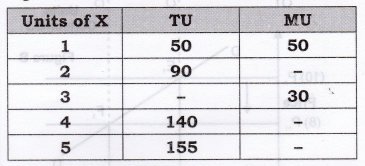

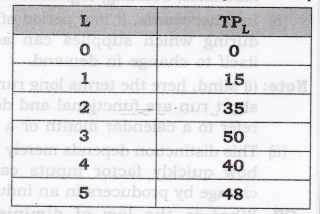

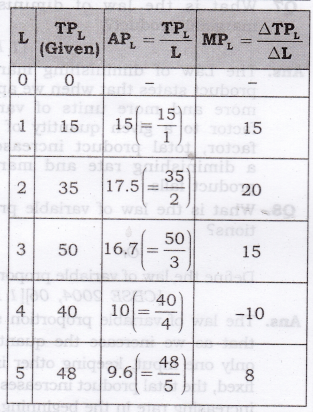

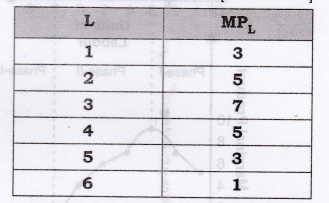

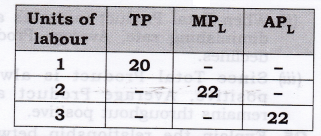

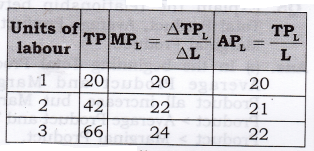

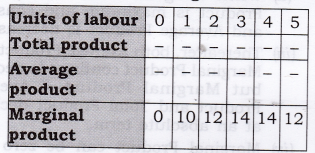

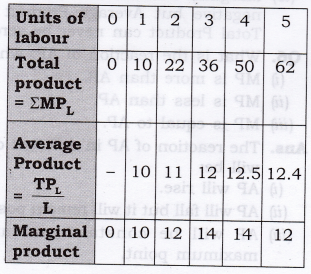

Question 9. The following table gives the total product schedule of labour. Find the corresponding average product and marginal product schedules of labour. [3-4 Marks]

Answer:

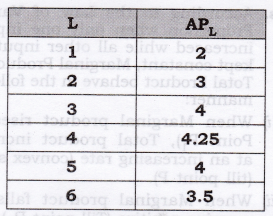

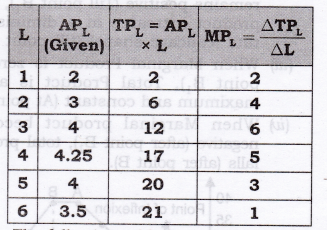

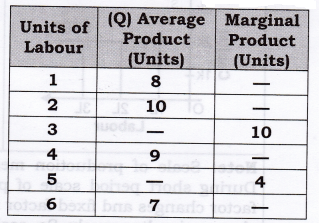

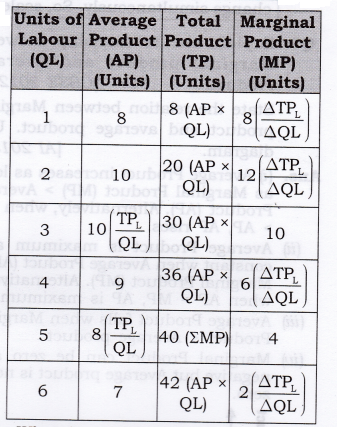

Question 10. The following table gives the average product schedule of labour. Find the total product and marginal product schedules. It is given that the total product is zero at zero level of labour employment. [3-4 Marks]

Answer:

Question 11. The following table gives the marginal product schedule of labour. It is also given that total product of labour is zero at zero level of employment. Calculate the total and average product schedules of labour. [3-4 Marks]

Answer:

Question 12. Let the production function of a firm be

Answer:

Q = 5 x 10 x 10 = 500 units So, the maximum possible output(Q) = 500 units.

MORE QUESTIONS SOLVED

I. Very Short Answer Type Questions (1 Mark)

Question 1. Give the meaning of production function. [CBSE 2007, AI 2011] Or

Define production function. [CBSE Sample Paper 2008]

Answer: The relationship between physical input and physical output of a firm is generally referred to as production function.

Question 2. In which run some factors of production are fixed and others are variable?

Answer: Short run.

Question 3. What change will take place in marginal product when total product increases at a diminishing rate? [CBSE Sample Paper 2010]

Answer: Marginal product will decline but remains positive.

Question 4. In which phase of Law of Variable Proportions a rational firm aims to operate?

Answer: Diminishing returns to a factor (Phase 2).

Question 5. What is meant by diminishing returns to a factor?

Answer: Diminishing returns to a factor refer to a phase when total product increases at a decreasing rate and marginal product falls, but remains positive with the increase in variable factor.

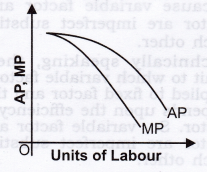

Question 6. What is the general shape of the AP and MP curves?

Answer: AP and MP curves are inversely U-shaped.

Question 7. How does fall in marginal production affect total output?

Answer: Fall in marginal product affects the total output in the following two manners:

- When marginal product falls, but remains positive, total product increases at a diminishing rate.

- When marginal product falls and become zero, total product falls in its absolute terms.

Question 8. Why MP curve cuts AP curve at its maximum point?

Answer: It happens because when AP rises, MP is more than AP. When AP falls, MP is less than AP. So, it is only when AP is constant and at its maximum point that MP is equal to AP. Therefore, MP curve cuts AP curve at its maximum point.

Question 9. Can AP rise when MP starts declining?

Answer: Yes, AP can rise when MP starts declining. It can happen as long as falling MP is more than AP. However, when MP becomes equal to AP, further decline in MP will also reduce AP.

Question 10. What is the shape of AP and MP?

Answer: Inverse U-Shaped.

Question 11. Give meaning of “Return to a Factor”. [CBSE 2013Q]

Answer: Return to a factor states that change in the physical output of a good when only the quantity of one input is increased, while that of other input is kept constant.

II. Multiple Choice Questions (1 Mark)

Question 1. The marginal product of a variable input is best described as:

(a) Total product divided by the number of units of variable input.

(b) The additional output resulting from one unit increase in the variable input.

(c) The additional output resulting from one unit increase in both the variable and fixed inputs.

(d) The ratio of the amount of the variable input that is being used to the amount of the fixed input that is being used.

Answer: (b)

Question 2. Diminishing marginal returns implies:

(a) Decreasing average variable costs.

(b) Decreasing marginal costs.

(c) Increasing marginal costs.

(d) Decreasing average fixed costs.

Answer: (c)

Question 3. The short run, as economists use the phrase, is characterized by:

(a) At least one fixed factor of production and firms neither leaving nor entering the industry.

(b) A period where the law of diminishing returns does not hold.

(c) No variable inputs that is all the factors of production are fixed.

(d) All inputs being variable.

Answer: (a)

Question 4. The marginal, average, and total product curves encountered by the firm producing in the short run exhibit all of the following relationships except:

(a) When total product is rising, average and marginal product may be either rising or falling.

(b) When marginal product is negative, total product and average product are falling.

(c) When average product is at its maximum, marginal product equals average product, and total product is rising.

(d) When marginal product is at a maximum, average product equals marginal product, and total product is rising.

Answer: (d)

Question 5. To economists, the main difference between short run and long run is that:

(a) In short run all inputs are fixed, while in long run all inputs are variable.

(b) In short run the firm varies all of its inputs to find the least cost combination of inputs.

(c) In short run, at least one of the firm’s input level is fixed.

(d) In long run, the firm is making a constrained decision about how to use existing plant and equipment efficiently.

Answer: (c)

Question 6. Which one of the following statements is the best definition of production function?

(a) The relationship between market price and quantity supplied.

(b) The relationship between the firm’s total revenue and the cost of production.

(c) The relationship between the quantities of inputs needed to produce a given level of output.

(d) The relationship between the quantity of inputs and the firm’s marginal cost of production.

Answer: (c)

Question 7. Diminishing returns occur:

(a) When units of a variable input are added to a fixed input and total product falls.

(b) When units of a variable input are added to a fixed input and marginal product falls.

(c) When the size of the plant is increased in the long run.

(d) When the quantity of the fixed input, is increased and returns to the variable input falls.

Answer: (b)

Question 8. If the marginal product of labour is below the average product of labour, it must be true that:

(a) The marginal product of labour is negative.

(b) The marginal product of labour is zero.

(c) The average product of labour is falling.

(d) The average product of labour is negative.

Answer: (c)

Question 9. The average product of labour is maximized when marginal product of labour:

(a) Equals the average product of labour.

(b) Equals zero.

(c) Is maximized.

(d) None of these.

Answer: (a)

Question 10. The law of variable proportions is drawn under all of the assumptions mentioned below except the assumption that:

(a) The technology is changing.

(b) There must be some inputs whose quantity is kept fixed.

(c) We consider only physical inputs and not economically profitability in monetary terms.

(d) The technology is given and stable.

Answer: (a)

Question 11. Average product is defined as:

(a) Total product divided by the total cost.

(fa) Total product divided by the marginal product.

(c) Total product divided by the variable input.

(d) Marginal product divided by the variable input.

Answer: (c)

Question 12. The change in the total product resulting from a change in a variable input is:

(a) Average cost (b) Average product

(c) Marginal cost (d) Marginal product

Answer: (d)

Question 13. Marginal product, mathematically, is the slope of the

(a) Total product curve

(b) Average product curve

(c) Marginal product curve

(d) Implicit product curve

Answer.(a)

Question 14. Diminishing marginal returns for the first four units of a variable input is exhibited by the total product sequence:

(a) 50, 50, 50, 50

(b) 50, 110, 180, 260

(c) 50, 100, 150, 200

(d) 50, 90, 120, 140

Answer: (d)

III. Short Answer Type Questions (3-4 Marks)

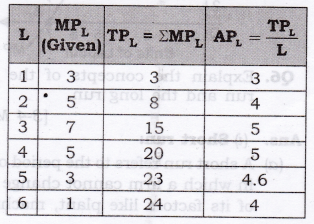

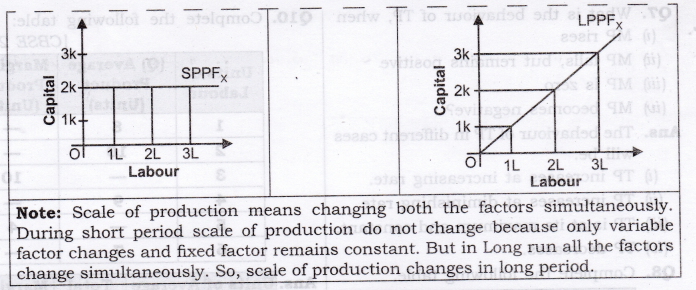

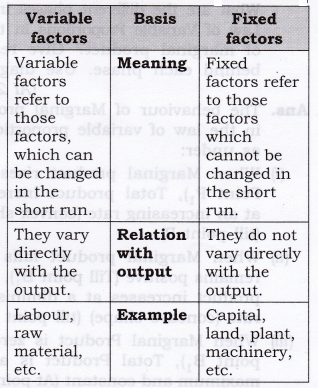

Question 1. Differentiate between Short Period and Long Period.

Answer:

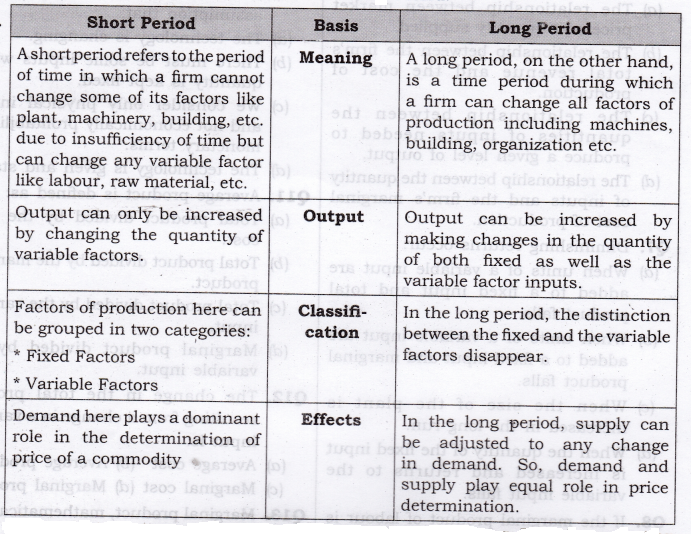

Question 2. Differentiate between Short Period production and Long Period production function.

Answer:

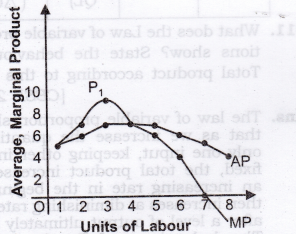

Question 3. Explain the relationship between Marginal product and Average Product. Or [CBSE 2012 C]

State the relation between Marginal product and average product. Use diagram. [AI 2013C]

Answer:

- Average Product increases as long as Marginal Product (MP) > Average Product (AP). Alternatively, when MP > AP, AP rises.

- Average Product is maximum and constant when Average Product (AP) = Marginal Product (MP). Alternatively, when AP = MP, AP is maximum.

- Average Product falls when Marginal Product < Average product.

- Marginal Product can be zero and negative but Average product is never zero.

Question 4. Explain the relationship between Total Product and Average Product.

Answer:

- When Total Product increases at an increasing rate, Average Product also increases.

- When Total Product increases at a diminishing rate, Average Product declines.